CLOs: From a Niche Element of Credit Markets to a Foundational Pillar of Institutional Yield Strategies

“Following an extended period of reduced activity due to a number of internal and external factors, including interest rate uncertainty, previously high inflation and geopolitical uncertainty, the leveraged finance market saw a welcome resurgence last year. 2024 was the busiest 12-month period since 2021, with the combined volume of total issuance of leveraged loans and high-yield bonds across U.S. and European markets more than doubling compared to 2023, while private credit continued to gain more market share across different markets and jurisdictions”. – Baker McKenzie.

In other words, leveraged finance is transitioning from a niche corner of credit markets into a foundational pillar of institutional yield strategies. Despite the existence of concerns regarding credit quality and interest rate volatility, the resurgence of Collateralized Loan Obligations (CLOs) (actively-managed Special Purpose Vehicles) reflects a broader re-engagement with structured credit. 1

What is leveraged finance, and what are CLOs?

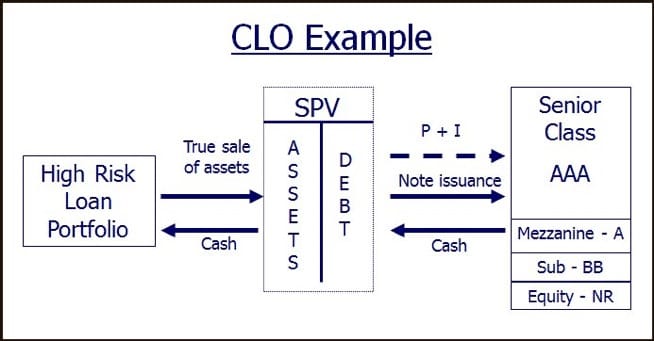

Leveraged finance refers to the financing of highly-levered, speculative companies. A derivative of debt financing, it involves lending capital to companies with lower credit rating (i.e. B or lower). These companies borrow money in the form of leveraged (below investment grade) loans. Due to the risky nature of these loans, banks abstain from holding them, and sell them off to Collateralized Loan Obligation (CLO) managers, who bundle these loans up into groups of 150-200 loans to create a Collateralized Loan Obligation or CLO.2 In order to fund the purchase of these loans, CLO managers divide up already-existing CLOs into tranches, and sell off some tranches in exchange for capital. Regarding tranches, there are 2 types: debt and equity tranches. Debt tranches are similar to bonds with credit ratings (AAA to BB and lower) and fixed coupon payments; are divided according to creditworthiness. The most creditworthy loans are classified into AAA tranches, while the least creditworthy loans are classified to C tranches; the most creditworthy tranches are paid off first (AAA tranches paid first, C paid last). Equity tranches are paid after all debt tranches. Such tranches offer ownership of the CLO in lieu of a cash flow payment and offer higher risk and return than debt tranches. Well-performing loans (high interest rates and paid on time) inject a large amount of cash into the SPV. Once all the debt tranches are paid off, the remaining cash gets allocated to the equity tranche. In essence, since equity tranches get paid off last, they take the hit first if borrowers’ default or interest rates tank.3

Market Growth and Financial Performance

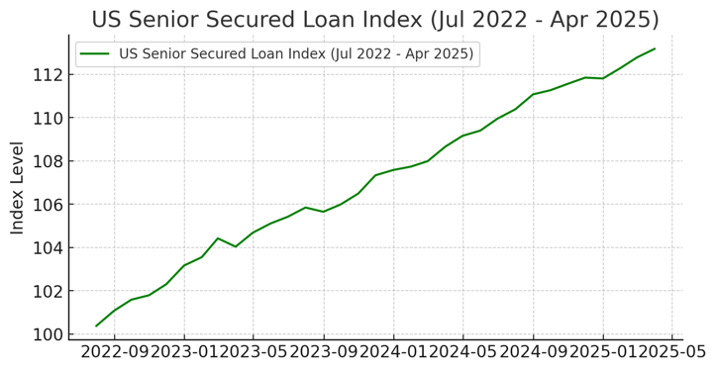

The global CLO market was valued at US $1.26 T in 2022 and is expected to reach US $2.71T by 2028. Median equity distributions reached multi-year highs as recent as 2024, with a 16% annualized distribution in the US, and 19% in Europe. The CLO market’s rapid growth is attributed to low interest rates. Due to low interest rates, investors are struggling to find investments with high yields, and hence are looking for alternative opportunities that have a higher ROI. CLOs (especially the equity tranche) offer higher yields than bonds and traditional investments, since they are comprised of risky, high interest loans. The market’s rapid growth is further attributed to the incorporation of technology and adaptation to market trends. Such trends include: growing private debt, an increase in TRACE trading, a narrowing bid/ask spread, and low default rates, and have culminated in a compounded annual growth rate (CAGR) of 14% between 2023-2028.4 The increase in CLO demand has resulted in a rise in the US Senior Secured Loan Index, as shown in the figure below.

Source: FDIC

2025 Outlook

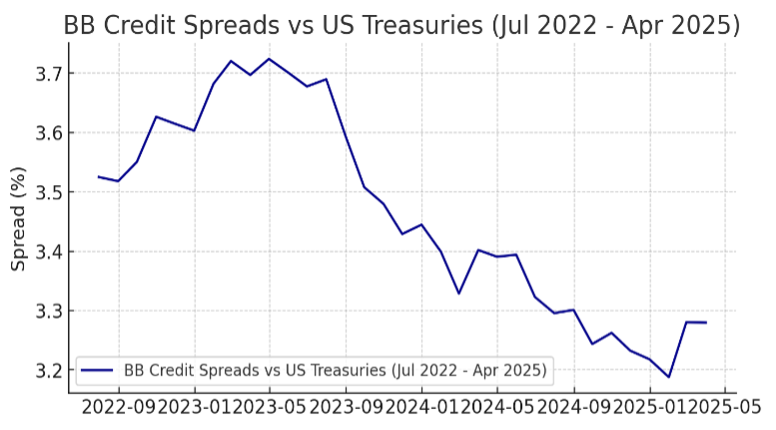

The global decline in interest rates would result in a projected drop-off in CLO collateral defaults from 5.6% to 2.6% in the US, and from 3.3% to 2.7% in Europe.5 This is a very positive development, resulting in an increase in CLO bond demand. Credit spreads hence have overall tightened for CLO investment-grade bonds. This means that investors are willing to reduce such bond premiums, as they: 1. see the borrower as less risky and 2. there is an increase in demand for CLO investment-grade loans. For instance, AAA CLO bonds are forecasted to reach SOFR + 110 (1.1%) bps in the first half of 2025, a 15-20 (0.15-0.2%) drop from 2024-year end.6 The drop in credit spreads is illustrated in the figure below:

Source: FDIC

Even though the decrease in investment-grade CLO spread in 2025 reduces its ceiling relative to before, the asset class still offers strong relative value. Such CLOs still offer better returns than alternatives, while having floating rates which are advantageous in volatile environments.7

In 2025, private credit/middle market CLOs are expected to offer interest rates similar to public-market loans (Broadly Syndicated Loans or BSLs). This indicates that investors carry a bullish sentiment regarding loans arranged by non-bank lenders such as investment funds and asset managers.

In the back-end of 2024, CLO exchange-traded-funds (ETFs) had over US $20 B of assets under management (AUM), a 10x increase from the 2023 AUM of US $2.25 B. This increase signifies that CLOs can become more popular amongst retail investors, enabling the CLO market to become more mainstream and liquid in the near future.7

Risks

The 3 main risks associated with CLOs are default risk, downgrade risk, and volatility in the greater market. Default risk is self-explanatory, as a sizeable portion of the CLOs consist of leveraged, below investment grade loans, and there is a high risk that borrowers would default. Regarding downgrade risk, both the loans and tranches can be downgraded by rating agencies. This would facilitate forced selling by managers sensitive to ratings, causing a “herd mentality” were several managers simultaneously sell their assets, amplifying market volatility. Finally, equity tranches in CLOs are extremely volatile, as they are hit first when markets tank. Here, when the borrowers default, the cash coming in from loan repayments drops sharply. The senior tranches still have to be paid, meaning that little to no capital is left to pay off the equity tranche.8

ArcStone’s view

The CLO market enters 2025 at a turning point. After a year of exceptional growth, particularly in the CLO ETF space and private credit-backed issuance, investor confidence is surging. Yet, short-term risks remain, including tighter spreads, a potential uptick in defaults from lower-rated borrowers, and growing macroeconomic uncertainty. In the near term, floating-rate structures, continued demand from retail and institutional investors, and enhanced ETF accessibility are expected to drive the market's expansion.

Markets have been extremely volatile on account of actions by the Trump administration’s imposition of tariffs on Liberation Day (April 2, 2025), leading to several US trading partners such as China, Canada and the EU to adopt retaliatory and countermeasures. This has been followed by period of negotiations stabilising the credit markets after a period of high volatility. All this has created uncertainty and downside risks, resulting in volatility in the bond markets and a spike in credit spreads across non investment grade high yield bonds.

Looking ahead, as the CLO ecosystem matures—with improved transparency, more active retail participation, and deeper integration with private credit—CLOs are positioned to evolve from a niche institutional product into a core fixed-income allocation. This transformation will be driven by the convergence of innovative fund structures, resilient loan performance, and investor demand for diversification and rate protection in volatile environments.

For investors, CLOs present a unique asymmetry: offering attractive yields, diversification, and floating-rate protection, but also carrying risks around credit quality, liquidity, and economic shifts. While the asset class is becoming more mainstream and investable, challenges around complexity and regulatory scrutiny remain. The opportunity is compelling—especially in a high-rate world—but it demands a nuanced, risk-aware approach and a willingness to navigate evolving market dynamics.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients with financings, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.