Copper's Long-Term Outlook: A Strategic Commodity in the Energy Transition

Copper, often dubbed the "metal of electrification," is poised to remain a critical element in the evolving global economic and industrial landscape. Despite recent market turbulence, including surpluses and high inventories, the long-term outlook for copper is underpinned by structural demand drivers, primarily the global energy transition, urbanization, and advancements in digital technologies such as artificial intelligence. As the global economy evolves, copper's role continues to shift from a cyclical commodity to a strategic resource with increasing structural demand.

Current Market Dynamics: Short-Term Surplus Weighs on Prices

Copper prices in 2024 reflect the commodity's inherent volatility and sensitivity to supply-demand dynamics. The year began with optimism as prices reached $5.20 per pound in May, buoyed by expectations of U.S. Federal Reserve rate cuts, which fueled a temporary bullish sentiment. However, the market saw a reversal by August, with prices falling below $4.00 per pound due to mounting concerns about projected surpluses and record-high inventories.

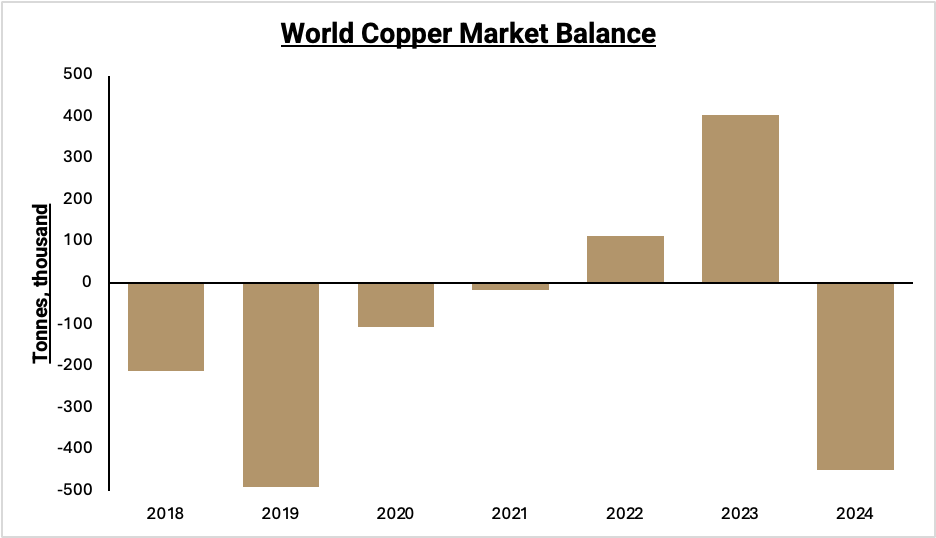

The International Copper Study Group (ICSG) forecasts a surplus of 469,000 tons in 2024. Major exchanges, including the London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE), reported inventories surging to 521,000 tons by October—a stark reminder of near-term oversupply issues that weigh on the market's short-term prospects.

Source: ANZ Research

Despite these headwinds, recent analyses from Jefferies and Goldman Sachs suggest a bullish turn. Jefferies points to an impending "extended period of deficits," highlighting that current inventory levels cannot mask the structural challenges in meeting future demand. Goldman Sachs echoes this sentiment, forecasting a price surge to $10,000 per ton by year-end 2024 and $12,000 per ton by Q1 2025.

The Energy Transition: Copper's Indispensable Role

Copper's intrinsic properties, such as high conductivity and durability, make it essential to the global energy transition. Renewable energy technologies, electric vehicles (EVs), and energy storage systems depend heavily on copper. For instance, an EV requires roughly four times as much copper as a conventional internal combustion engine vehicle. Moreover, the expansion of renewable energy infrastructure, including wind and solar power, demands substantial amounts of copper for wiring, transformers, and grid upgrades.

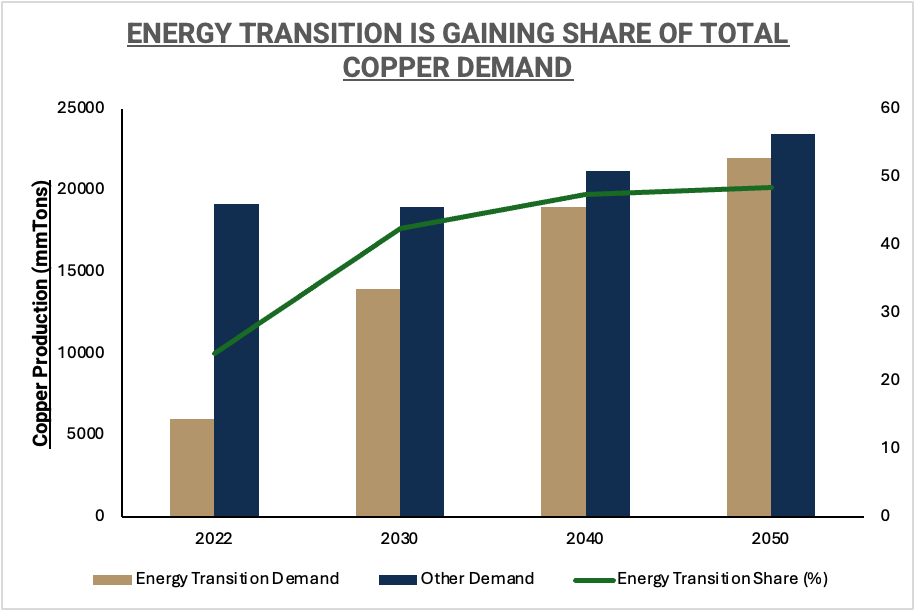

The International Energy Agency (IEA) estimates that achieving net-zero emissions by 2050 could drive annual copper demand to 40 million tons, a significant increase from today's levels. The transition to clean energy is no longer a theoretical possibility—it is a global imperative reinforced by governmental policies and corporate commitments worldwide.

Source: Global X ETFs with information derived from Bloomberg NEF. Transition Metals Outlook 2023.0

According to ANZ Research, clean energy technologies now account for 22% of total copper demand—a figure that is expected to rise significantly over the next decade. As renewable energy adoption accelerates, copper's essential role in facilitating a low-carbon future becomes increasingly evident, underscoring its long-term value proposition.

Digital Infrastructure: A Rising Demand Driver

While the energy sector drives much of the conversation around copper, the digital economy is emerging as an underappreciated catalyst for demand. The rapid proliferation of data centers, artificial intelligence, and cloud computing has created unprecedented needs for copper-intensive infrastructure, making the metal a backbone for modern technological advancements.

BHP highlights how the growth of data centers is a game-changer, requiring reliable and efficient electrical systems powered by copper to manage the ever-growing volumes of data. As technological innovations advance and connectivity become more integral to daily life, copper's strategic importance in supporting digital infrastructure is poised to grow significantly.

Jefferies' March 2024 report emphasizes that current demand forecasts may underestimate copper consumption in digital infrastructure. The expanding adoption of AI-driven solutions and high-performance computing systems is expected to amplify copper's strategic importance, making it an irreplaceable component of modern economies.

Supply-Side Constraints: Challenges in Meeting Demand

Copper's abundance in the earth's crust does not translate into an equally abundant supply. Extracting and processing copper faces increasing challenges, such as declining ore grades, underinvestment in mining projects, and geopolitical risks that complicate the supply chain. Countries like Chile and Peru, which account for a significant share of global copper production, are grappling with labor strikes, political instability, and regulatory hurdles that restrict output and investment.

According to S&P Global, annual copper supply deficits could exceed 10 million tons by 2035. This projection accounts for new mining projects and increased recycling efforts but highlights the industry's inability to keep pace with rising demand. Furthermore, the development of greenfield mining projects, which typically require over a decade to bring online, remains a critical bottleneck for the global copper supply chain.

Supply disruptions also pose significant risks to the market. Over the past two decades, unplanned events have curtailed mine production by an average of 5.5% annually, as noted by ING. For 2024, these disruptions are already impacting forecasts, with growth estimates for mine production reduced from over 6% to 3.9%. Such challenges reinforce the urgent need for investment and innovation in mining and recycling to address the widening gap between supply and demand.

Conclusion: Copper's Strategic Role in a Changing World

Copper's long-term outlook is anchored in its indispensable role across industries. While short-term dynamics, such as surpluses and price volatility, may dominate headlines, the broader narrative remains compelling. The global energy transition, digital transformation, and emerging markets like India are converging to create unprecedented demand for copper.

The supply side, however, remains constrained by underinvestment and operational challenges. This imbalance underscores the need for higher copper prices to incentivize new mining projects and recycling efforts. For investors, copper represents a unique opportunity with structural growth potential.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients in raising growth capital, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.