Crude Awakening – What’s Fueling Oil’s Climb?

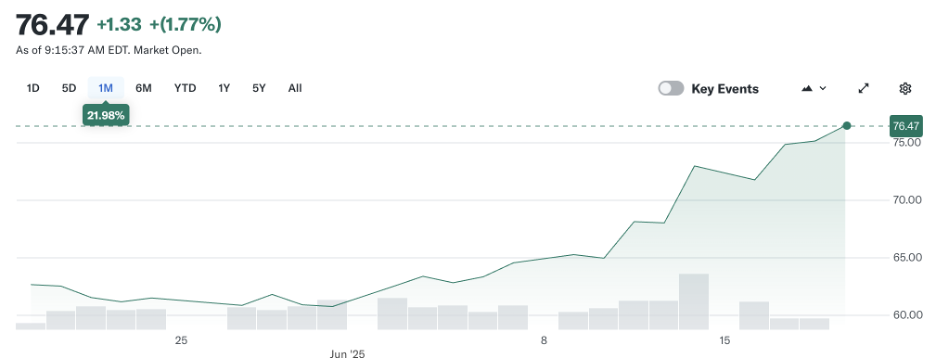

Oil prices have steadily risen through the first half of 2025, reflecting a resurgence in geopolitical risk, strong structural demand, and shifting supply dynamics. Since early Q1, Brent crude has rallied over 22%, trading above $82 per barrel as of mid-June.1 This multi-month surge has been underpinned by a convergence of global tensions, tightening physical supply, speculative positioning, and rising inflation hedging.2 As markets face escalating Middle East instability and uncertain trade policy from the United States, oil is reasserting its importance as both a geopolitical barometer and economic shock absorber.

Global Instability Amplifies Safe-Haven Oil Bid

Rising military tension in the Middle East—particularly the June 2025 Israeli airstrikes on Iranian military sites—has reignited fears of a broader regional conflict, prompting oil traders to price in significant risk premiums. Iran has publicly threatened to restrict or block traffic through the Strait of Hormuz, a chokepoint responsible for nearly 20% of global crude flows.3 While no formal closure has occurred, Iranian officials have floated the idea of requiring oil tankers to obtain passage approval, triggering a sharp rise in shipping insurance costs—up over 60%, from 0.125% to 0.2% of a vessel’s value—and prompting some vessels to consider rerouting.4President Trump’s public demands for Iran’s “unconditional surrender” on June 17, 2025, and warnings that U.S. patience was wearing thin, triggered a sharp reaction in oil markets. Brent crude rose approximately 4.4% that day, climbing from around $73 to $76.45 per barrel.5 Combined with earlier gains following Israeli airstrikes on Iranian military targets, oil prices surged by more than 10% over several trading days as geopolitical tensions escalated and traders priced in heightened risk premiums.6 In tandem, U.S. tariff escalations and trade frictions with the EU and Canada have injected further volatility. Recent sanctions on energy imports and manufacturing equipment have disrupted flows and inflated freight rates, with tanker shipping costs to Asia rising over 50% since April.7 These twin shocks—conflict and tariffs—have re-established crude oil as a defensive hedge in institutional portfolios.

Supply Dynamics Remain Constrained

Over the past two weeks, there have been no major new developments regarding structural supply constraints. OPEC+ maintained its previously announced plan to increase output by 411,000 barrels per day in July, signaling a gradual and measured approach without any unexpected disruptions.8 U.S. shale production remained steady, with no material growth reported—consistent with ongoing capital discipline among operators. Likewise, there were no new reports of supply interruptions from traditional conflict-prone regions such as Iraq, Libya, or Nigeria. While Canadian wildfires disrupted a portion of oil output earlier in June, no similar events occurred during the past two weeks, leaving the broader supply outlook relatively unchanged.

Investment Activity and Futures Markets Reflect Renewed Optimism

Institutional positioning in the oil market has turned increasingly bullish over the past several weeks, with net speculative long positions in Brent and WTI crude futures climbing to nearly 192,000 contracts as of June 13—the highest level in over two months.9 This surge reflects a broader rotation by hedge funds and commodity traders back into energy markets, driven by inflation hedging and heightened geopolitical risk. Options activity has also spiked, with WTI $80 calls seeing their highest volume since January, underscoring the market’s conviction in further price gains.10 Meanwhile, energy-focused ETFs have attracted renewed inflows, and the Energy Select Sector SPDR Fund (XLE) has outperformed the broader S&P 500 year-to-date, buoyed by strong earnings from integrated producers and refiners.

Future Outlook & Key Catalysts – Will Oil Stay Elevated?

1. Middle East Risk Premium

Escalating tensions in the Gulf, including recent Israeli airstrikes and Iranian threats to the Strait of Hormuz, have kept a substantial risk premium priced into oil. Goldman Sachs estimates this premium at around $10 per barrel, and analysts warn that any disruption to Hormuz traffic could push Brent well above $100 per barrel.11

2. Strategic Repositioning by Producers

OPEC+ is maintaining a cautious approach, approving a modest 411,000 barrels per day increase for July, rather than opting for a more aggressive ramp-up—a strategy mirrored through May and June.12 Meanwhile, flat non‑OPEC+ production and continued capital discipline in U.S. shale suggest limited incremental supply growth, implying that oil prices could remain supported in the $85–95 range through Q3.13

3. Global Demand Recovery

Demand in Asia remains robust: India’s fuel consumption in May reached its highest point in over a year, while the IEA projects continued global demand growth through 2029 despite slower EV adoption in China.14Seasonal factors—such as summer travel demand—are likely to tighten balances further into late 2025.

4. Macroeconomic and Monetary Policy

The Federal Reserve is signaling potential two interest rate cuts by year-end, with policy expected to remain unchanged in the near term. Softer real rates and a weaker U.S. dollar bolster oil’s appeal as a tangible asset and inflation hedge, reinforcing positive inflows into commodities.15

ArcStone’s View

At ArcStone, we believe the recent strength in oil prices is not a short-lived reaction but rather a reflection of deeper structural and macroeconomic forces at play. While geopolitical tensions have added volatility and short-term premiums, the real story lies in the persistent disconnect between growing global demand and constrained supply-side flexibility. OPEC+ has demonstrated continued caution in its production strategy, and U.S. shale remains disciplined despite higher prices—suggesting that meaningful supply growth will take time to materialize. On the demand side, consumption trends in Asia, strong summer seasonality, and a rebound in petrochemical and aviation fuels continue to support a constructive outlook. Looking forward, we expect oil to remain well-supported in the near term, barring any major supply shock or economic downturn. Investor positioning reflects this view, as inflows into energy-linked assets have accelerated amid softening monetary conditions and ongoing concerns around inflation resilience. While risks remain—particularly surrounding potential disruptions in the Strait of Hormuz—we see the market increasingly pricing in oil as a stabilizing force in a highly uncertain global environment.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients with financings, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.