Lobe Sciences Ltd. - Undervalued Pioneer in Rare Disease Innovation

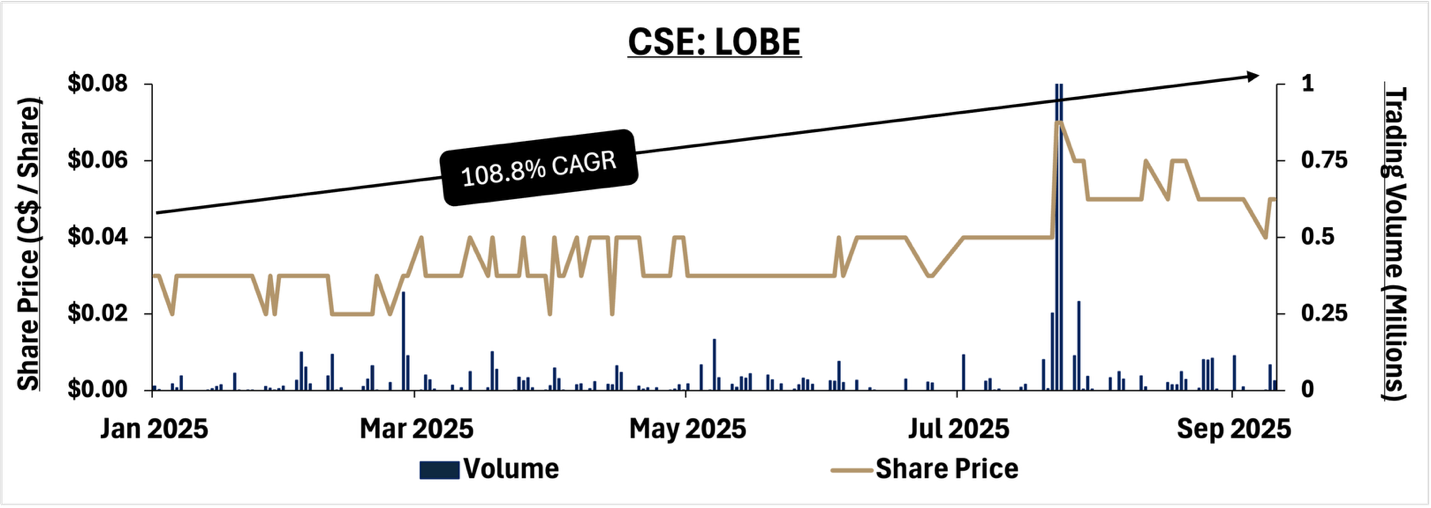

Recent Milestones

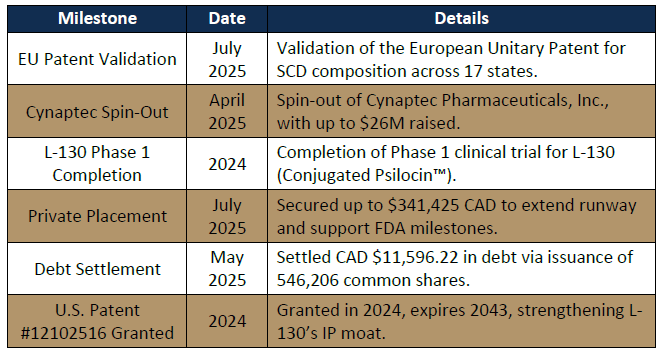

Share Price Performance

Lobe Sciences Ltd. (CSE:LBOE) share price performance January 1st 2025 – September 12th 2025.

Key Achievements

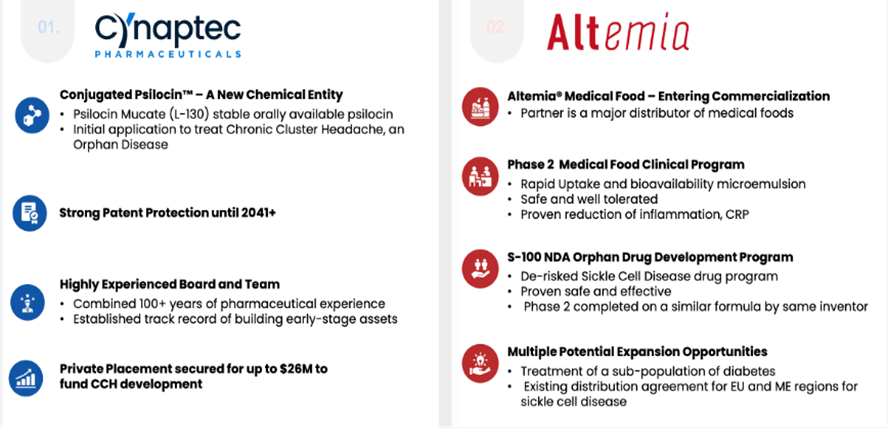

• Altemia (acquired in April 2023) bypasses Phase 3, generated CA $136,205 in 2024 and targets CA $10–20M by 2027 via an exclusive U.S. deal with Pentec Health.

• Cynaptec’s L-130, has completed Phase 1 and is advancing Phase 2 for chronic cluster headaches; it’s spin-out structure streamlines development and creates significant value opportunity for Lobe.

• CA $26M private placement with warrants funds Altemia’s rollout and Cynaptec’s trials.

• Strong IP protection, including a 2024 U.S. patent and EU patent validation (July 2025), positions both assets for near-term and long-term value creation.

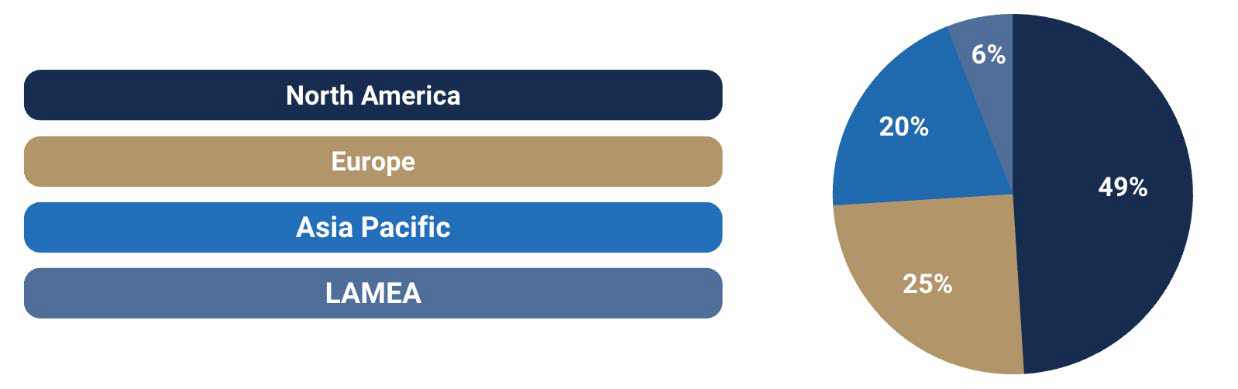

Market Size and Sub-Sector Analysis

The global rare disease treatment market is undergoing a transformative growth phase, supported by advances in biotechnology, increasing awareness, and strong regulatory incentives. The market, valued at USD 224.3B in 2024, is projected to grow to US $244.6B in 2025 and reach US $527.1B by 2034, achieving a compound annual growth rate (CAGR) of 8.92% over the forecast period (2025– 2034).1

Key Growth Drivers:

• Regulatory Incentives: Policies like the U.S. Orphan Drug Act offer fast-track approvals, tax incentives, market exclusivity, and grants.

• Biotech and R&D Expansion: Major pharmaceutical firms and clinical-stage biotech companies are investing heavily in rare disease pipelines.

• Unmet Clinical Need: Over 10,000 rare diseases affect 30 million Americans. Many of these diseases have no FDA-approved treatments.

• Technological Innovation: Use of CRISPR, gene therapy, and AI-driven drug discovery to target specific molecular and genetic profiles.

Key Restraints:

• High Trial Costs: Small patient populations make clinical trials expensive and difficult to recruit for.

• Limited Reimbursement: High treatment costs often limit accessibility, especially in developing regions.

Strategic Opportunities:

• Personalized Medicine: Tailoring therapies to specific genetic profiles can yield breakthroughs in efficacy.

• Market Consolidation: M&A activity by firms like Pfizer, AstraZeneca, and Merck signal confidence and appetite for acquisition of promising assets.

• Public-Private Partnerships: Collaborations between academia, biotech startups, and major pharma players accelerate drug development.

Rare Diseases Treatment Market Share by region (2024, %)

Sub-Sector Analysis: 2

By Drug Type:

• Biologics (2024 Share: >82%)

o Includes monoclonal antibodies, gene therapies, recombinant proteins.

o Enables precise targeting of molecular disease pathways.

o Examples: Enzyme replacement therapies for Gaucher disease, gene therapy for hemophilia.

• Non-Biologics (High Growth Segment)

o Includes small-molecule drugs, often orally available.

o Easier to manufacture and distribute, especially for emerging markets.

o Advances in AI-based molecular design improving efficacy.

By Therapeutic Area:

• Rare Cancers (2024 Share: ~50%)

o Includes rare leukemias, sarcomas, and lymphomas.

o High clinical urgency, personalized oncology is enabling tailored regimens.

o Rapid innovation in tumor profiling and immunotherapies.

• Blood-Related Disorders (High CAGR)

o Includes sickle cell disease, hemophilia, and thalassemia.

o High chronic burden, requiring lifetime care.

o Gene editing and enzyme replacement therapies are transforming standard of care.

• Neurological & Metabolic Disorders

o Includes Huntington's disease, cystic fibrosis, and DMD.

o Often affect pediatric populations; long-term treatment pathways necessary.

o Market growth driven by FDA’s pediatric rare disease programs.2

By Route of Administration:

• Injectables (Dominant Segment)

o Preferred for biologics and unstable molecules.

o High bioavailability, particularly critical for enzyme and gene therapies.

• Orals (Fastest Growing Segment)

o Enhanced compliance, ease of use.

o Drug delivery tech (e.g., nanoformulations) enabling transition of biologics to oral delivery.

By Distribution Channel:

• Specialty Pharmacies: Handle complex logistics, patient education, and high-cost therapies.

• Hospital Pharmacies: Central to tertiary care centers and academic hospitals.

• Online Pharmacies: Gaining traction with increased home-based care and chronic disease monitoring.

Company Snaphot

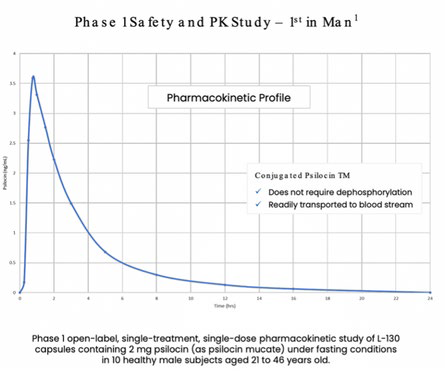

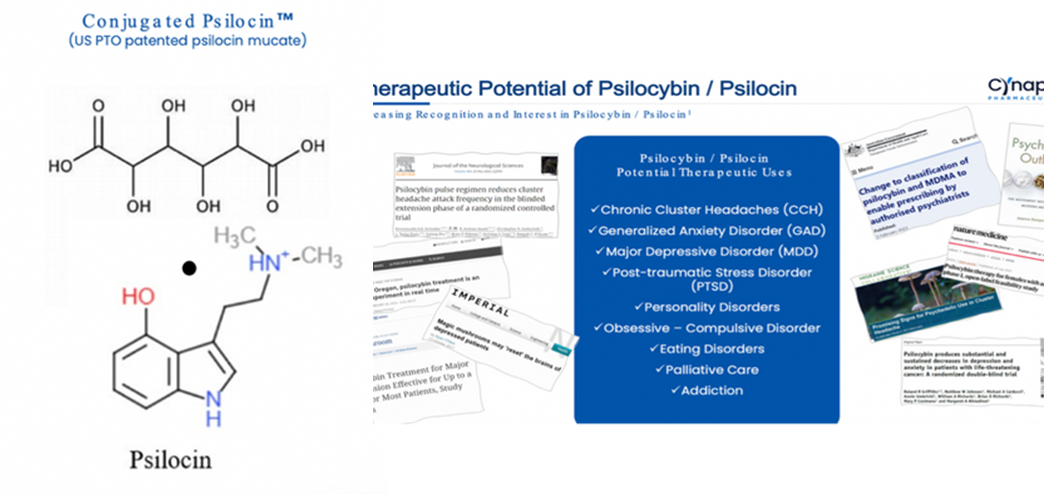

Lead Asset – Conjugated Psilocin™

• Therapeutic Focus: Chronic cluster headaches (an Orphan Disease), with additional research into substance use disorders.

• Mechanism: A patented, oral, stable analog of psilocin designed for enhanced bioavailability without hallucinations.

• Differentiation: Unlike psilocybin (a prodrug), Conjugated Psilocin™ is fully bioavailable and stable, overcoming typical formulation challenges.

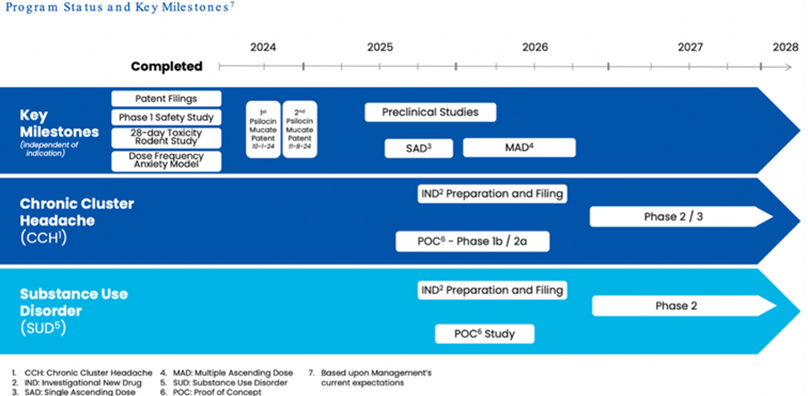

• Development Milestones:

o Pre-IND feedback received from FDA.

o Phase 1 clinical trial completed.

o Phase 2a trial supported by current funding.

o Potential CA $20M option to fund Phase 3.

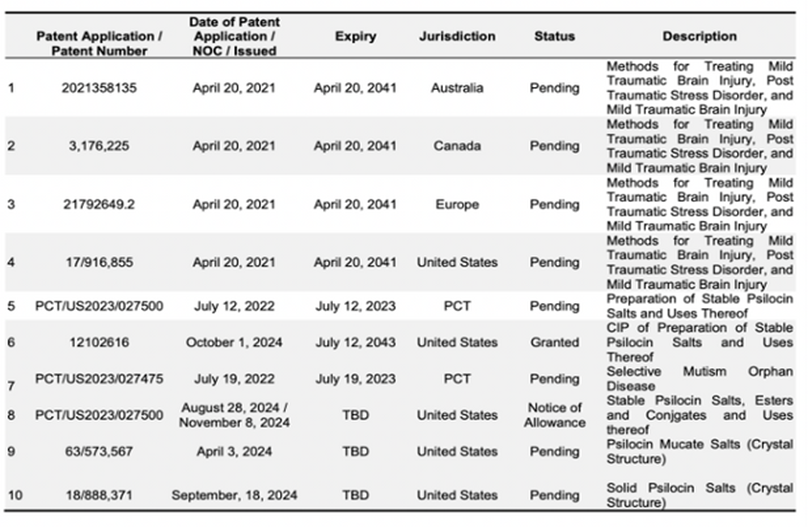

• IP Position: Two U.S. patents granted covering composition, use, and 3 production; valid until 2043. International patents filed.3

Spinout – Cynaptec Pharmaceuticals

In April 2025, Lobe spun out Conjugated Psilocin™ to Cynaptec Pharmaceuticals, a Delaware-based private entity. Lobe transferred full IP and commercial rights to Cynaptec but retained a 64% equity stake after a $6M private placement. This structure supports streamlined clinical development and financing.

Strengths and Weaknesses

Strengths:

• Secured 2 US patents for psilocin mutate.

• Successfully completed and published Phase 1 clinical trial results.

• Received FDA pre-IND feedback, advancing toward human clinical trials.

• Well funded: CA $26M July private. placement and July raise provide solid runway across Altemia and Cynaptec.

• Proven team: Led by FDA veteran Dr.Sancilio, backed by seasoned biotech and capital market executives.

Weaknesses:

• Multiple convertible notes with 10% interest rate indicate high cost of capital.

• FDA Regulatory Risk: Lobe’s long- term upside hinges on FDA approval for Cynaptec’s L-130. Despite strong leadership and pre-IND traction, regulatory uncertainty around psychedelics, especially non- hallucinogenic analogs, could delay timelines or impact valuation, making this a key risk to monitor.4

Second Asset – Altemia® Medical Food

• Indication: Sickle Cell Disease (SCD), targeting long-chain fatty acid deficiencies.

• Formulation: DHA-based oral emulsion to improve fatty acid balance and red blood cell function.

• Target Population: ~100,000 patients in the U.S. and ~10 million globally, with high prevalence among African American, Middle Eastern, and South Asian populations.

• Market Advantage: Limited treatment options currently available; physician- supervised formulation ensures clinical oversight.

• IP Protection: Recently validated EU Unitary Patent across 17 countries, 5 covering composition and method of use.5

Strategic Highlights

• Pipeline Strategy: Focus on rare neurological conditions with unmet needs to leverage regulatory incentives and pricing power.

• Ownership & Control: Maintains direct commercial activities through Alera and Altemia while pursuing high-potential clinical assets via Cynaptec.

• Regulatory Strategy: Targeting Orphan Drug designation and further regulatory alignment as clinical milestones advance.

• Strategic Partnership: Exclusive agreement with Clearway Global to accelerate drug development through expert regulatory, clinical, and manufacturing support.6

|

Company Name |

Ticker |

Focus Area |

Market Cap (US

$) |

Enterprise

Value (US $) |

EV/R&D

Multiple |

Notes/Lobe

Discount |

|

|

Compass Pathways |

CMPS |

Psilocybin for depression |

415.1M |

97.2M |

8x |

Phase 3b ongoing |

|

|

Cybin Inc |

CYBN |

Psilocybin analogs for CNS |

180.0M |

62.1M |

6x |

Phase 3 is ongoing |

|

|

Atai Life Sciences |

ATAI |

Psychedelics Platform |

725.7M |

762.5M |

7x |

Phase 2b (completed; results: July 2025) |

|

|

GH Research |

GHRS |

Psychedelics for CNS |

910.0M |

584.7M |

5x |

Phase 2b completed |

|

|

Global Blood Therapeutics |

ACQ |

SCD Drugs |

Acquired 3.9B |

N/A |

N/A |

Phase 3 completed |

|

|

MindMed |

MNMD |

Psychedelics |

642.2M |

645.4M |

9x |

Phase 3 ongoing |

|

Compass Pathway

Strengths:

- More advanced (Phase 3b); institutional investor support.

- Strong academic affiliations (e.g., King’s College, NYU).

- First-mover in TRD psilocybin trials.

Weaknesses

- Hallucinogenic: burdensome trial protocols, supervised administration required.

- Less scalable due to need for controlled setting.

- Limited orphan strategy; generalized CNS focus lacks regulatory leverage.

- Lobe’s non-hallucinogenic and orphan indications offer a faster, leaner path.7

ATAI Life Sciences

Strengths:

- Broad CNS pipeline with multiple shots on goal.

- Large market cap (~US $1B) and VC backing (Peter Thiel).

- Diversified platform with cognitive enhancers, psychedelics, and MDMA analogs.

Weaknesses:

- Burn-heavy business model; high dilution.

- Many programs still preclinical or early-stage like Lobe.

- No clear lead program like L-130 in cluster headache.8

MindMed

Strengths:

- Advanced LSD analogue in Phase 2.

- Strong branding in retail investor communities.

- Expanding indications in anxiety and ADHD.

Weaknesses:

- Requires prescription, regular monitoring, and has a more severe side effect profile.

- Not suitable for all pediatric patients; drug resistance or compliance issues can emerge.

- Expensive therapy: limits access in developing markets.

- Altemia, as a non-drug, can be purchased and consumed daily with minimal oversight, making it more accessible.10

Global Blood Therapeutics

Strengths:

- FDA-approved pharmaceutical therapy with clinical efficacy data.

- Backed by Pfizer’s deep distribution, payer access, and capital.

- Addresses root cause of HbS polymerization in SCD.

Weaknesses:

- Requires prescription, regular monitoring, and has a more severe side effect profile.

- Not suitable for all pediatric patients; drug resistance or compliance issues can emerge.

- Expensive therapy: limits access in developing markets.

- Altemia, as a non-drug, can be purchased and consumed daily with minimal oversight, making it more accessible.10

GH Research

Strengths:

- GH001 has completed multiple Phase 2 trials for TRD, while Cynaptec’s L-130 is still preclinical.

- NASDAQ listing gives GH001 better market visibility and access to institutional investors than private Lobe.

- GH001’s ultra-fast onset and short duration (15–20 min) make it ideal for rapid psychiatric intervention.

- The company’s focused development strategy with clear endpoints appeals to biotech investors.

Weaknesses:

- GH001 requires in-clinic supervision, limiting chronic/outpatient scalability.

- Targets crowded CNS markets, unlike Lobe’s focus on orphan indications with exclusivity and pricing power.

- Weak IP around 5-MeO-DMT vs. L-130’s strong patents (U.S./EU, to 2043).

- Inhalation model not suited for take- home use; L-130 is non-hallucinogenic and outpatient-compatible.

- 5-MeO-DMT’s intense, variable effects may face regulatory pushback; L-130 has clean, consistent dosing. 11

Cybin Inc.

Strengths:

- CYB003 (deuterated psilocybin) is already in Phase 2 trials for Major Depressive Disorder — ahead of Cynaptec’s L-130.

- Diversified pipeline with multiple CNS programs (e.g., anxiety, alcohol use disorder).

- Listed on NYSE American with greater liquidity and funding access.

- Strong focus on drug delivery innovation (e.g., deuteration, inhalation).

- Institutional partnerships (Clinilabs, Flow Neuroscience) streamline R&D execution.

Weaknesses:

- Compounds are still hallucinogenic, requiring in-clinic supervision.

- Targets broad CNS markets (MDD, anxiety), lacking orphan exclusivity or pricing leverage.

- IP based on modifications of known compounds, easier to work around than Lobe’s novel analog.

- No near-term revenue — unlike Lobe’s Altemia which is already commercial.

- Burn-heavy model with valuation volatility and dependence on public financing.12

Lobe’s Relative Positioning:

Scientific Edge

- Lobe’s edge comes from proprietary platforms addressing critical gaps: Conjugated Psilocin offers 100% bioavailability, long-term stability, no hallucinations at 4mg, and strong Phase 1 data de-risked by FDA feedback and toxicology.

- Altemia rebalances fatty acids, cutting inflammation by 39% and boosting DHA uptake by 113% with a safe, natural mechanism. Both are patented in the U.S./EU, de- risked, and scalable for orphan markets.

Highlights

Lobe combines near-term, de-risked revenue from Altemia with the high-upside potential of Cynaptec, offering both operational growth and a clear spin-off arbitrage opportunity for shareholders.

Altemia – De-risked revenue profile

- A medical food for SCD with a CA $5B+ market, on track for full commercialization by mid-2026.

- Backed by a streamlined regulatory path, exclusive U.S. distribution with Pentec Health, and projected revenue growth from CA $136K in 2024 to CA $10–20M by 2027.

Cynaptec – High-reward CNS (Central Nervous System) pipeline

- In the U.S. alone, an estimated 7 million patients with anxiety, 17 million with depression, 8 million with PTSD, and 20 million with addiction (of which 4 million are currently in treatment) represent a substantial addressable market. Successful commercialization could unlock CA $300–400 million in potential annual revenue.

- Phase 2 program underway, supported by Phase 1 data showing a positive PK profile, clean 28-day toxicology, and 4 mg dose with anxiolytic effects.

- Valuation comps: COMPASS (CA $572M, Phase 3b) and ATAI (CA $1B, Phase 2b).

- CA $26M investment (April 2025): CA $6M initial tranche plus CA $20M option, valuing Cynaptec at CA $13.6M and positioning it for a spin-off rerating.

Pipeline and Clinical Progress

Lobe operates through two segments:

- Altemia™, a medical food for sickle cell disease (SCD) and inborn errors of metabolism in both pediatric and adult patients, launched in 2023 and is progressing with North American commercialization, European distribution, and an exclusive U.S. partnership with Pentec targeting 100K patients. Its medical food classification streamlines regulation, enabling faster revenue generation for a market of ~100K U.S. patients and ~20M globally, while its European Unitary Patent, validated in July 2025 across 17 states, strengthens IP protection.

- Cynaptec focuses on L-130, a stabilized, non-hallucinogenic psilocin analog for chronic cluster headache, with toxicology studies in mice (50x human dose) confirming safety, rat studies showing anxiolytic effects at 4mg, and validated pharmacokinetics supporting an FY2025 IND filing, significantly reducing clinical risk.

- Additional programs include L-131 for pediatric anxiety and S-100 for SCD, with Conjugated Psilocin™ (U.S. Patent #12102516, expiring 2043) and pending patents further de-risking Cynaptec’s stake.

- IP Advantage: Conjugated Psilocin™ is protected by U.S. Patent #12102516 (2024, expiring 2043), with additional pending patents further de-risking Cynaptec’s stake.

Leadership

Lobe is led by Dr. Fred D. Sancilio, a biotech veteran with 1,500+ compounds developed and multiple FDA approvals. The Board is chaired by Philip Young, an experienced biotech leader with several successful exits, while COO Rick Goulburn, a former Merck executive who led a US $1B acquisition, oversees operations. They are supported by Wesley Ramjeet (30+ years in capital markets/IPOs) and Dr. Herman Williams (former head of operations for 43 U.S. hospitals, now leading Altemia), forming a team that de-risks orphan disease execution.13

Recent Momentum

- Share price jumped from CA $0.04 to CA $0.055 (37.5% increase), pushing the market cap from CA ~$8.58M to CA ~$11.80M, reflecting excitement around the CA $341,425 private placement (July 29) and Cynaptec’s progress.

- Private Placement: The CA $341K raise extends runway and signaling investor confidence for FDA milestones.

- Cynaptec Milestones: Pre-clinical stage with positive 28-day toxicology and 4 mg dose data sets up IND filing in FY2025. FDA nods (e.g., OPH) could boost momentum, per biotech trends.

Bigger Opportunity

Altemia offers a de-risked, near-term revenue stream, but Cynaptec represents the larger long-term opportunity. With exposure to the US $4–$8B psychedelics therapeutics market by 2030, its orphan drug focus enables faster FDA pathways, premium pricing, and substantial rerating potential. While Altemia’s medical food model drives steady cash flow (CA $136K in 2024 to CA $10–$20M by 2027), Cynaptec’s spin-out structure positions it as the true growth engine. Together, they create a balanced model of stability and transformative upside.

Risk Factor & Mitigations

- Clinical Delays: L-130’s Phase 2 timing risk is offset by FDA pre-IND feedback and a leadership team with 20+ successful drug approvals.

- Liquidity: Despite the CA $26M Cynaptec funding and a growing Altemia revenue, providing a clear funding bridge, liquidity remains tight at CA $364K (Q2 2025) with a CA $1.5M YTD loss.

- Dilution: The CA $1.5M convertible note could result in ~19% dilution if no IPO occurs, but a successful IPO would mitigate this by supporting a higher valuation.

|

Name |

Role |

Ownership

% |

|

Frederick Sancilio |

Chief Executive Officer |

~65% |

|

Wesley

Ramjeer |

Audit Chair, BOD |

~1.7% |

|

Harry R. Jacobson |

Director |

Minor |

|

Rick

Goulburn |

Board Member |

Minor |

|

Yong Yao |

CFO and EVP |

Minor |

Source: Market Screener

Subsidiary Ownership and Conversion Structure

Lobe Sciences operates or partners with early-stage subsidiaries that serve as R&D hubs. These are likely funded via convertible instruments, which are standard in biotech financing.

A. Pre-Conversion Structure:

- Lobe holds 100% equity in the subsidiary.

- Centralized IP, governance, and financing under the parent structure.

B. Convertible Mechanics:

- Convertible notes or preferred shares issued to investors.

- Conversion tied to milestones (e.g., IND approval, Series A funding, licensing deal).

- Typical conversion terms:

o Discount to next valuation round

o Valuation cap

o Anti-dilution provisions

C. Post-Conversion Impact:

- Lobe retains significant equity (contingent on raise size and cap table).

- Equity dilution balanced with strategic funding and valuation uplift.

- Option for Lobe to retain board control, IP rights, or licensing rights.

D. Parent-Level Strategic Benefits:

- NAV Uplift: Increase in valuation of subsidiary recognized in Lobe’s share price.

- Liquidity Optionality: Lobe can spin off, license, or sell the subsidiary.

- Royalty Streams: Monetization of IP through licensing agreements.

- Pipeline Diversification: Multiple shots on goal across rare disease segments.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.

DISCLAIMER

This company overview (the “Overview”) has been prepared by ArcStone Securities and Investments Corp. (“ArcStone”) for informational and marketing purposes only. It is intended solely for institutional, accredited, or qualified investors and does not constitute an offer to sell or a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. The information, opinions, and estimates contained herein reflect judgments as of the date of publication and are subject to change without notice. ArcStone makes no representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this Overview and expressly disclaims any and all liability arising from reliance thereon.

FORWARD-LOOKING STATEMENTS

This Overview may contain statements that constitute “forward-looking statements” within the meaning of applicable securities laws in Canada and the United States. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “potential,” “target,” and similar expressions. These statements are based on current expectations, estimates, and assumptions and are inherently subject to significant risks and uncertainties including business, operational, financial, market, regulatory, and geopolitical risks that could cause actual results to differ materially from those expressed or implied.

Forward-looking statements in this Overview may include, but are not limited to, statements regarding the subject company’s future outlook, business strategy, financial results, exploration and development plans, budgets, litigation, or objectives. Readers are cautioned not to place undue reliance on such statements and should review all relevant risk factors described in the company’s most recent public filings and continuous disclosure documents. Forward-looking statements speak only as of the date they are made, and except as required by law, ArcStone assumes no obligation to update or revise any forward-looking statements.

NO OFFER, NO RECOMMENDATION

This Overview is not, and under no circumstances, to be construed as, a prospectus, offering memorandum, advertisement, or public offering under any securities legislation. Nothing contained herein constitutes or should be deemed to constitute investment, legal, tax, accounting, or other professional advice, nor does this Overview constitute a recommendation to purchase, sell, or hold any security. Each recipient must conduct its own independent due diligence and consult its own advisors before making any investment decision.

REGULATORY STATUS

ArcStone Securities and Investments Corp. is not a FINRA-registered broker-dealer and does not execute securities transactions or provide investment advice to U.S. persons. All U.S. registrable activities, including securities offerings, private placements, or introductions of U.S. investors are conducted exclusively through ArcStone Securities, LLC and Kingswood U.S., each a FINRA and SIPC member broker-dealer. In Canada, all registrable activities are conducted on a transaction-by-transaction basis through Sentinel Financial Group, a registered Exempt Market Dealer (EMD) in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Northwest Territories.

ArcStone and its affiliates operate in compliance with applicable FINRA, SEC, CIRO, and CSA requirements and maintain appropriate information barriers between investment banking, research, and marketing functions.

ISSUER-SPONSORED AND COMPENSATION DISCLOSURE

The issuer featured in this Overview (the “Company”) is a current or recent client of ArcStone or one of its affiliates. ArcStone and/or its affiliates have received or expect to receive cash and/or equity compensation for the provision of research, corporate advisory, investor relations, digital media, or capital markets consulting services to the Company. This relationship represents a potential conflict of interest, as ArcStone may be perceived to have an incentive to present the Company in a favorable light.

ArcStone’s U.S. affiliate, ArcStone Securities, LLC, may seek to act, or may have acted, as a placement agent or underwriter for the Company. The principals, officers, directors, employees, and related entities of ArcStone and its affiliates may, from time to time, own, buy, or sell securities or derivatives of the Company or its affiliates.

INDEPENDENCE

This Overview has been prepared by ArcStone’s Capital Markets and Research Division, which operates independently from transactional business lines. The authors have not been promised, nor received, compensation directly or indirectly related to the specific views or recommendations expressed herein. ArcStone maintains internal policies and procedures designed to manage conflicts of interest and uphold objectivity in its research and marketing publications.

USE OF THIS Overview

This Overview is provided with the understanding that ArcStone is not acting in a fiduciary capacity. Recipients may not reproduce, distribute, or publish this Overview without the prior written consent of ArcStone. ArcStone assumes no obligation to update or amend this Overview or notify recipients if any information becomes inaccurate or misleading. By accepting this Overview, each recipient agrees to indemnify and hold harmless ArcStone and its affiliates from any claims, losses, or damages arising from reliance on this Overview or any errors or omissions herein.

Principals and/or staff of ArcStone may own shares in the subject company.

@ 2025 ArcStone Securities and Investments Corp. All rights reserved.