MiMedia Holdings Inc. (TSXV: MIM)

Introduction: The Evolution of Cloud Storage

In an era where digital content dominates everyday life, the need for seamless, secure, and intelligent media management solutions has never been greater. From personal photos and videos to crucial work files, individuals and businesses alike rely on cloud storage solutions for accessibility, security, and efficiency. Amidst the industry giants, one company is making waves by integrating cloud storage directly into smartphones, creating a unique and scalable business model, MiMedia Holdings Inc.

Company Overview: The Next Generation of Cloud Storage

MiMedia Holdings Inc. (TSXV: MIM, OTCQB: MIMDF, FSE: KH3) (“MiMedia” or the “Company”) is a next-generation AI and data-driven consumer cloud platform that enables users to securely store, organize, and share personal media across devices. The Company partners with smartphone OEMs and telecom carriers to integrate its platform natively at the system level, replacing the default gallery app and providing multiple recurring, high-margin revenue streams via partner-led distribution across global Android markets.

MiMedia’s go-to-market model is private-label and B2B2C, allowing telecom and device partners to brand the platform as their own while monetizing through mobile advertising, cloud subscriptions, and unique first-party data. This structure positions MiMedia to capture economic value at the intersection of content storage, mobile engagement, and on-device data personalization, particularly in markets underserved by Big Tech incumbents.

Strategic Outlook: Momentum Builds Through Mid-2025

In early 2025, MiMedia CEO Chris Giordano described the coming year as a critical inflection point for the Company’s global growth strategy:

"We are excited about 2025 and the foundation it lays for MiMedia’s future. Our high-margin, recurring revenue model, coupled with global expansion opportunities, sets the stage for unparalleled growth. We will continue to update investors as we execute on our strategy." – Chris Giordano, CEO (MiMedia Press Release 04.02.2025)

When MiMedia’s CEO described 2025 as a pivotal year, the Company was laying the groundwork for scalable global commercialization. Five months later, MiMedia has demonstrated meaningful traction: completing a CA $3.87M convertible debenture financing, expanding deployments across key telecom and OEM partners, and activating preloaded smartphones in multiple international markets.

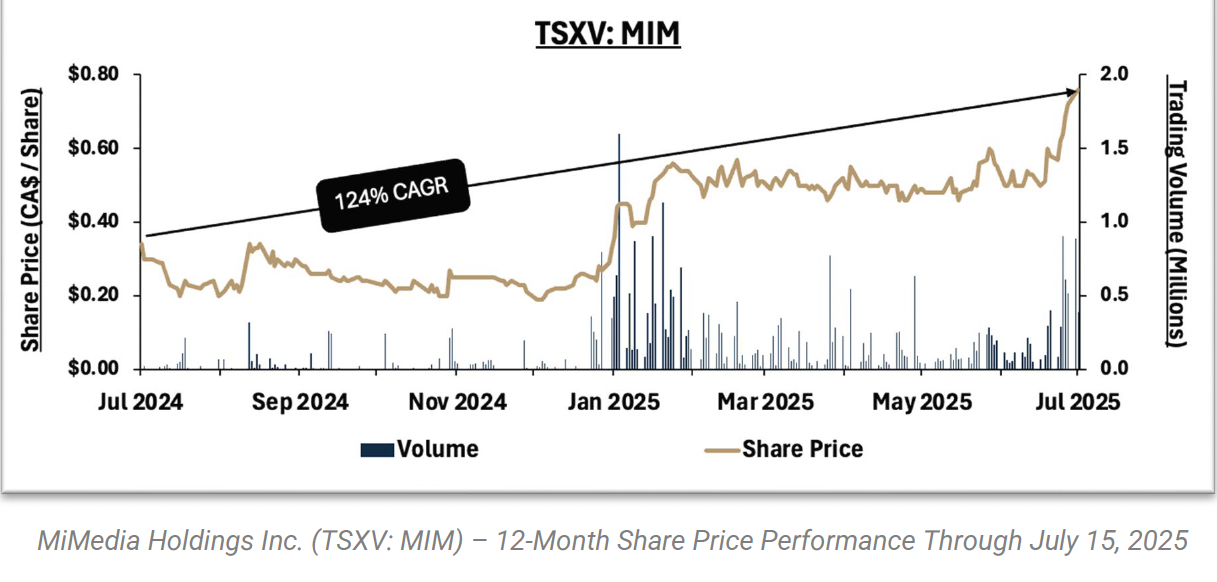

This commercial progress has coincided with a marked improvement in market valuation. As of July 15, 2025, MiMedia’s share price has appreciated by approximately 156.67% year-over-year, closing at CA $0.75, a 20.31% increase from the previous week. MiMedia’s share price is up already up ~50% from their last financing in June 2025.

With millions of MiMedia-integrated smartphones soon to be in circulation is second half 2025, and further expansion planned in Latin America, Southeast Asia, and Europe, in 2026. The Company is now actively transitioning from rollout to recurring monetization—underscoring its positioning as a differentiated platform in the global mobile cloud ecosystem.

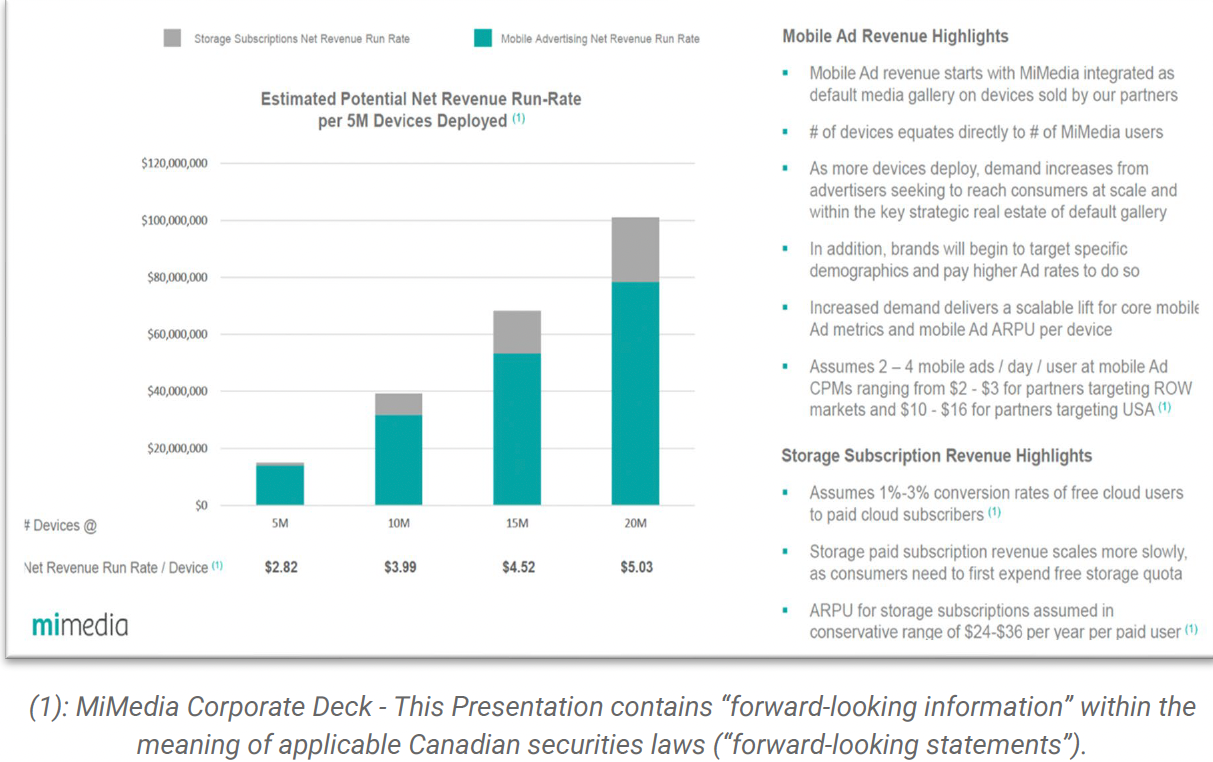

MiMedia's innovative business model projects two high-margin revenue streams:

● Digital Advertising Revenue – Built directly into MiMedia's platform across smartphones, tablets, desktops, and web applications. As user engagement grows, advertising revenue scales predictably, with MiMedia’s current projected CPM mobile advertising rates ranging from US $10-$15 for tier 1 markets.

● Cloud Storage Subscriptions – Users are offered premium storage tiers once they approach their free quota. Subscriptions are priced based on storage needs and are delivered through telecom or OEM partners, creating a sticky revenue stream that compounds with device deployment.

● Data Strategy – MiMedia’s new advanced data capabilities enhance demographic targeting, leading to higher mobile ad CPMs and stronger advertiser interest.

Target Markets:

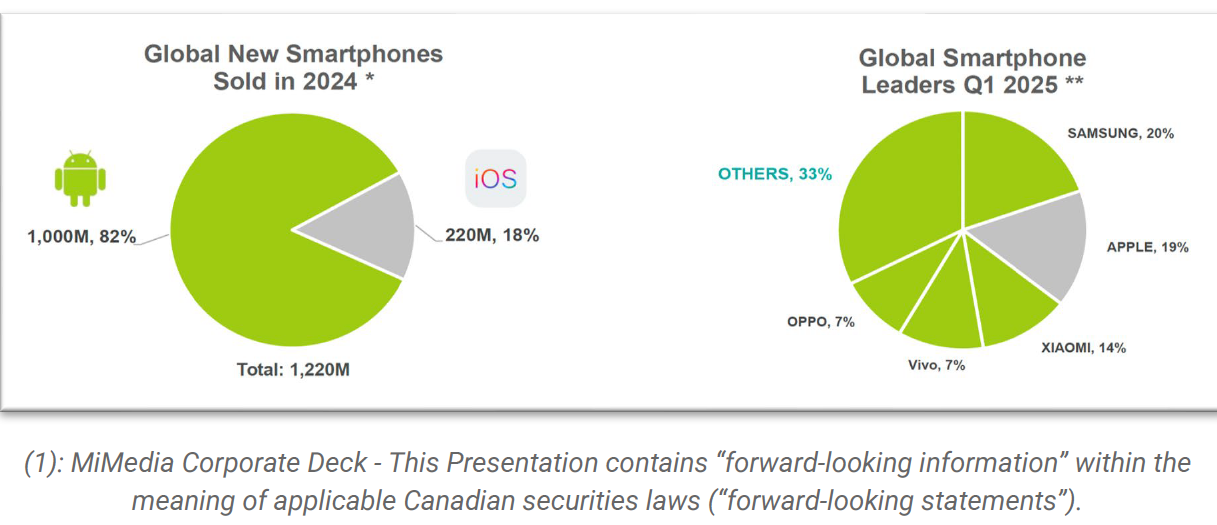

The global market opportunity is massive and uniquely well positioned for MiMedia. There are hundreds of Telcos and over 1.0B new Android smartphones sold every year which MiMedia can target.

MiMedia is the only third-party consumer cloud to:

1) Target this HUGE global market and

2) Replace boring, grid-based media galleries currently found on Android smartphones with MiMedia’s superior consumer cloud platform.

● For example, just a small % conversion of “Others” OEM category (approximately 400M phones) would deliver a massive opportunity.

● Estimated 40 OEMs in “Others”, however, only three OEMs use Google Photos as the default smartphone gallery.

Key Market Trends

● With over 5.64B internet users worldwide as of April 2025, accounting for 68.70% of the global population, the demand for seamless and secure media storage is at an all-time high. (Datareportal)

● Consumers expect intelligent media management solutions that offer features beyond simple storage, such as automated organization, private sharing, and AI-enhanced search capabilities.

● While subscription-based cloud storage remains prevalent, ad-supported models are gaining traction, allowing businesses to diversify revenue streams and cater to users hesitant to pay for storage. (Newswire)

2025 YTD Milestones: A Breakout Year for MiMedia

Growth Potential: Rollout of MiMedia-Integrated Smartphones

In 2025, MiMedia achieved a important milestone by initiating the deployment of smartphones preloaded with its AI-powered cloud storage platform. Through strategic partnerships with leading smartphone manufacturers, MiMedia's platform has in their plans to become the default media gallery application on millions of newly released devices. This seamless integration ensures that users automatically engage with MiMedia's services from the moment they power on their smartphones. (OTCMARKETS)

User adoption has been accelerating as these devices continue to enter the market. The company's real-time revenue dashboard reflects a steady increase in active users, reinforcing its scalable recurring revenue model. By embedding its platform into devices at the point of sale, MiMedia has eliminated the high customer acquisition costs associated with standalone apps.

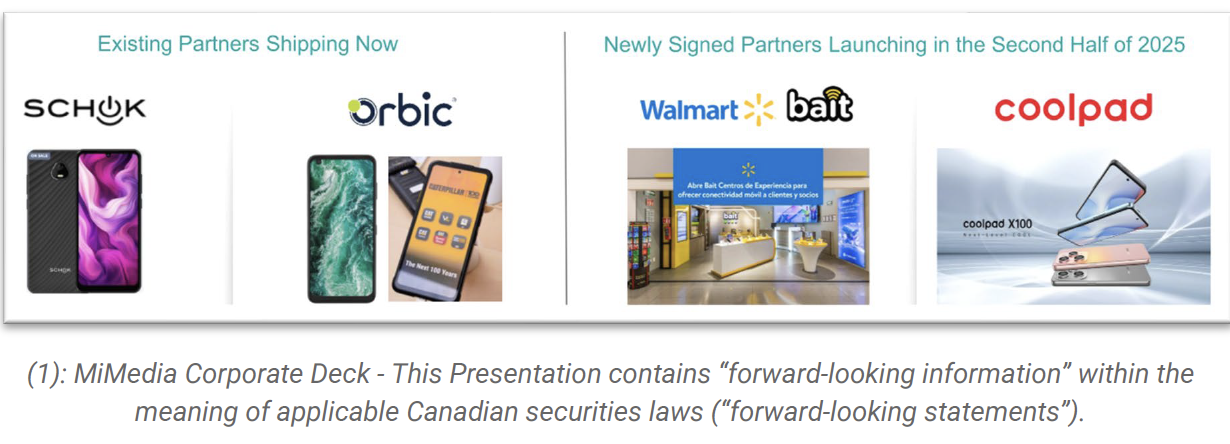

With millions of devices already contracted for MiMedia integration over the next two years, the company estimates a gross revenue opportunity exceeding US $125M in the US market alone (1). This projection is supported by established OEM partnerships with Schok and Orbic, which are already shipping MiMedia-integrated devices, as well as newly signed agreements with Coolpad and Walmart subsidiary Bait, both slated to launch in the second half of 2025. These figures underscore the significant impact of MiMedia’s built-in revenue model, leveraging recurring revenues from both advertising and storage subscriptions.

Beyond the US, MiMedia is in discussions with major telecom and OEM partners across the following regions to accelerate device integrations:

● Mexico and Latin America

● Southeast Asia

● Africa

(MiMedia Press Release 04.02.2025, MiMedia Corporate Deck (1) - This Presentation contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”).)

Strengthening Financial Position: Convertible Debenture Financing

To support ongoing commercialization across global telecom and smartphone OEM partners, MiMedia has press released on July 2nd, 2025 that they have closed a CA $3.87M private placement of unsecured convertible debenture. The proceeds will help fund deployments currently underway in the United States, Mexico, and Europe, as the Company scales its embedded media cloud platform.

Each debenture unit was issued at a principal amount of CA $1,000 and carries a 12.5% annual interest rate, maturing on June 27, 2027. Interest is payable semi-annually in cash or shares, with the first payment scheduled for December 31, 2025.

Beginning June 27, 2026, debentures are convertible at the holder’s option into

Each unit also includes two tranches of warrants:

• 769 warrants exercisable at CA $0.65 per share, valid from June 27, 2026, to June 27, 2027.

• 500 warrants exercisable at CA $1.00 per share, valid from June 27, 2026, to June 27, 2027.

All securities are subject to a statutory hold period through October 28, 2025, and the Company may complete additional closings subject to exchange approval (MiMedia Press Release 08.07.2025).

The financing significantly enhances MiMedia’s balance sheet at a critical stage of commercialization. With over CA $3.87M in new capital and flexible terms, the Company is positioned to accelerate global deployments, fund partner activation efforts, and strengthen execution across its contracted pipeline. The non-dilutive structure of the debentures, convertible after one year and repayable in cash or equity, preserves shareholder alignment while extending MiMedia’s operating runway.

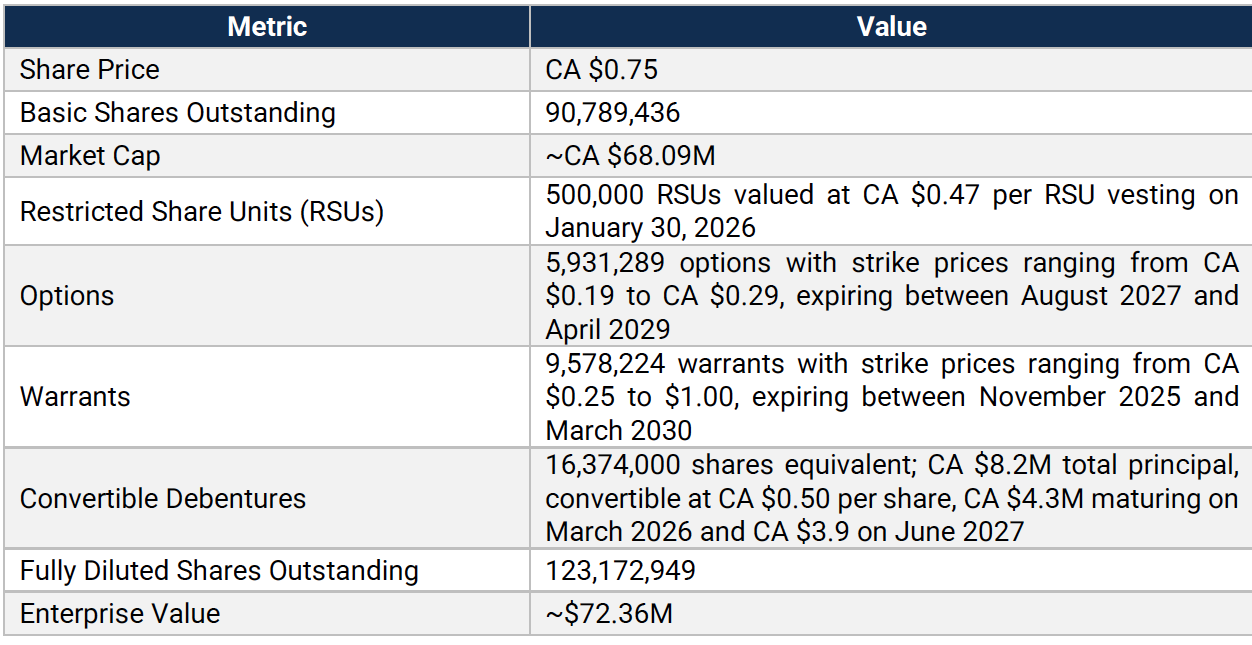

Financial Snapshot (As of July 15th, 2025)

The following table outlines MiMedia’s current capital structure and enterprise value following the close of its CA $3.87M convertible debenture financing.

MiMedia’s Patent-Backed Competitive Advantage: A Rare Opportunity

MiMedia is not just disrupting the cloud storage industry, it’s securing its leadership position with a robust patent portfolio that safeguards its AI-powered media management and seamless OEM integrations. These proprietary innovations create barriers to entry, ensuring MiMedia remains the only third-party consumer cloud

With millions of preloaded devices already contracted and a rapidly expanding footprint, the window for investors and partners to capitalize on this first-mover advantage is narrowing. The opportunity is now—before the market fully recognizes MiMedia’s transformative impact. (1): MiMedia Corporate Deck - This Presentation contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”).

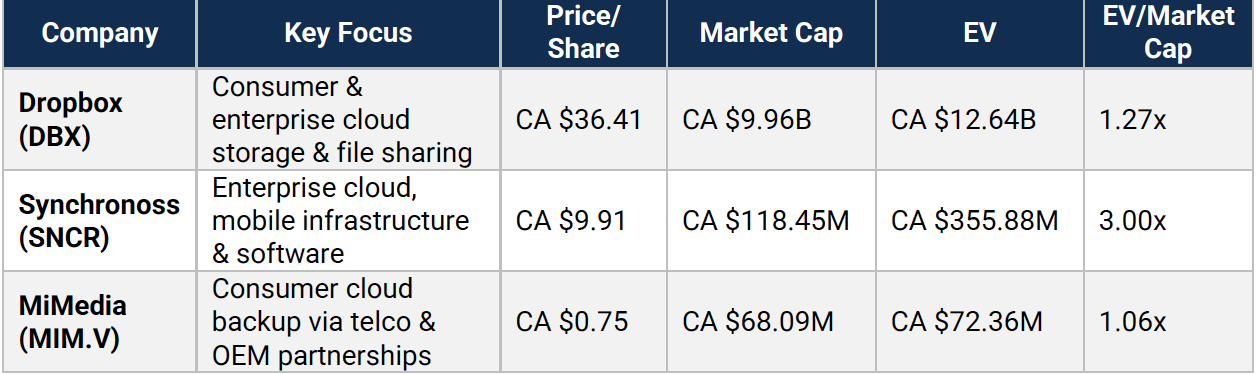

Comparable Companies (As of July 15th, 2025)

As of July 15th, 2025, MiMedia trades at a modest CA $68.09M market cap with a 1.06x EV/Market Cap multiple, positioning it competitively against peers like Dropbox (1.27x), and Synchronoss (3.00x). Unlike its peers focused on traditional cloud storage or enterprise infrastructure, MiMedia stands out through its telco and OEM-integrated consumer cloud platform, enabling direct device embedding and broad distribution. This partnership-driven model offers scalable user acquisition and recurring revenue potential, suggesting strong upside as MiMedia continues activating these relationships.

ArcStone’s View: MiMedia is positioned to scale significantly as it begins activating partnerships with major OEMs and retailers including Schok, Walmart subsidiary Bait, Coolpad, and Orbic. These collaborations enable MiMedia’s cloud platform to be embedded directly into mobile devices and retail channels, unlocking broad consumer reach, accelerating user acquisition, and creating a strong foundation for recurring revenue growth. What sets MiMedia apart from larger competitors is its privacy-first, white-label approach and its focus on pre-installation through device manufacturers. This allows for cost-efficient distribution and ownership of the user relationship without relying on app store downloads or paid advertising. This embedded model not only drives faster user growth but also offers OEM partners a differentiated cloud solution tailored to their ecosystem.

Legal Disclosure:

ArcStone Securities and Investments Corp. (“ASIC”) is not a licensed securities dealer in either the United States or Canada. All securities-related activity is conducted through ArcStone Securities LLC, a separate and duly registered broker-dealer with FINRA. This communication does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is intended solely to present an overview of MiMedia Holdings Inc. for informational purposes.