Powering the Future: Semiconductor Chip Market Overview

What Exactly are Semiconductors?

Semiconductors are materials with electrical conductivity between the levels of conductors (like metals) and insulators (like rubbers). They are typically silicon based and serve as the foundation for most modern technological components. They are essential to a wide range of devices and systems, powering everything from smartphones, laptops, and data centers to electric vehicles, medical equipment, and even spacecrafts. [1]

Market Growth: An Amazing Recovery

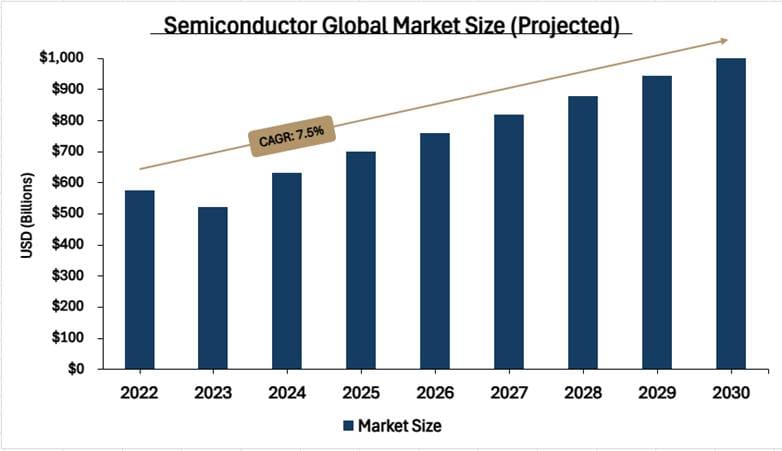

According to the Semiconductor Industry Association (SIA), global semiconductor sales reached $167.7B in the first quarter of 2025, an 18.8% year over year increase.[2] During 2024, the global sales of semiconductors totaled $627.6B, up almost 20% from $526.8B in 2023, which was a year that had seen a notable decline due to an overall decrease in demand and post-pandemic effects. This drop was followed by a strong rebound as demand for AI, cloud computing, and other next new technologies increased, which all rely on semiconductors, driving the sector's demand as well.[3]

Analysts now project growth to continue for the rest of 2025, with the global semiconductor sales expected to approach $700B, set to reach $1T around 2030 (CAGR of 7.5%). To support this growth, the semiconductor industry is expanding manufacturing capacity and R&D through heavy capital investments, which are to reach $185B in 2025. [1]

Some Driving Forces

Artificial Intelligence

- The generative AI boom is a major catalyst for semiconductor demand. The global AI chip market is projected to experience significant growth, with estimates predicting a valuation of $621.15B by 2032 (~30% CAGR), with data center chip sales, from companies like NVIDIA, AMD, and Intel, reaching record highs. [4]

Automotive and Industrial Transformation

- The automotive market and industrial efforts in general rely heavily on semiconductor chips for their technological capabilities. The global automotive semiconductor market size is calculated at $50.59B in 2025 and is forecasted to reach around $102.15B by 2034 (CAGR of 8.12%). [5]

Data Centers

- With increasing global demand for large scale data centers, cloud computing services, and many more, this sector relies heavily on the semiconductor sector to support its growth. The global data center market size is valued at $386.71B in 2025 and is estimated to reach $1T by 2034 (CAGR of 11.24%). [6]

Industry Structure and Regional Trends

Overall growth in this sector is heading towards a more diversified state as of early 2025. Experiencing rapid growth, North America leads in sales growth (up 45.3% in Q1 2025), driven by over $500 billion in investments in U.S.-based chip manufacturing, packaging, and AI infrastructure since 2020. This surge is supported by federal incentives such as the CHIPS Act and the Advanced Manufacturing Investment Credit, helping to reinvigorate domestic production and strengthen supply chain resilience. [7] [8]

Asia-Pacific remains the worlds primary manufacturing hub for semiconductors, led by Taiwan, South Korea, and China. The region continues to expand its capacity for production along with R&D as reflected in Asia-Pacific/All Other up 15.4% and China up 7.6% in sales. [7]

Europe is also increasing efforts in the semiconductor sector through efforts such as the EU Chips Act, where they aim to double their market share by 2030. Currently, they are focused on building new plants for development and R&D to reduce their reliance on external suppliers. [9]

The industry includes a mix of business models:

· Foundries (TSMC, Samsung): Specialize in manufacturing chips designed by other companies.

· Integrated Device Manufacturers (Intel, Texas Instruments): Handle both design and fabrication.

· Fabless Companies (NVIDIA, Broadcom): Focus solely on chip design, outsourcing manufacturing to foundries.

· Equipment and Material Suppliers (ASML, Applied Materials): Provide the machinery and raw materials required for chip production

Challenges Ahead

Despite the current growth, the industry still faces many risks:

- Geopolitical Tensions: Global tensions, particularly between US and China are reshaping global trade and semiconductor supply chains. US export control along with Chinas retaliatory measures have heighted risks. Chinas military activity near Taiwan, a key producer, adds further uncertainty. [10]

- Supply Chain Fragility: Even though the chip shortages from the past few years has eased, there are still some shortages related to the raw materials needed like neon gas and other rare earth metals. These issues are compounded by the global tension's effects on the global supply chain, creating more uncertain and rising costs. [10]

- Sustainability and Energy Constraints: Rising energy consumption and the need for sustainable manufacturing practices are becoming more necessary as chip production grows. By 2030, electricity demand by the semiconductor industry is expected to reach 237 TWh, contributing to rising greenhouse gases.[11]

ArcStone's View

The semiconductor industry is not just rebounding; it's redefining the global technology landscape. With AI/ML, automotive, and industrial applications fueling this growth, this industries strategic importance and long-term demand trajectory are clearer than ever.

For investors, the sector offers both growth potential and defensive qualities. Industry leaders such as NVIDIA and TSMC benefit from their strong pricing power, while equipment providers like ASML maintain near monopolies in manufacturing essential technologies.

Short-term, the consolidation, geopolitical shifts and the continued R&D will define the market performance, while long-term, semiconductors will power the future technologies of the next decade, and more to come.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients with financings, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.