Quantum Technology 2025: Emerging Frontier, Enduring Risks

“The quantum computing market stands at an inflection point, with technological progress and commercial interest converging to create significant growth opportunities. While the path to widespread quantum computing adoption may be complex, the market's fundamental drivers remain strong, suggesting continued expansion and evolution in the coming years.” — Research and Markets[1]

Quantum computing is evolving from a theoretical curiosity into a cornerstone of frontier technology strategy. Although general purpose quantum machines remain a decade or more from widespread use, recent advances in quantum-inspired software, hybrid quantum-systems, and government backed development programs suggest the beginning of a measurable shift in the commercialization path.

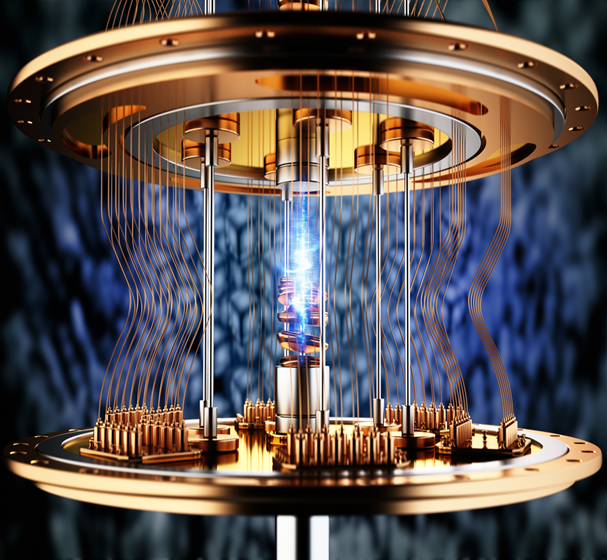

What is Quantum Computing?

Quantum computing is a next generation computational model that uses the principles of quantum mechanics, such as superposition (where a qubit can represent a combination of multiple states, like 0 and 1, at the same time) and entanglement (where two qubits become linked so that the state of one instantly affects the other, even at a distance) to process information in fundamentally new ways. The way classical computers work is by representing information in bits, 1s and 0s, whereas quantum computers use qubits, which can be in superposition.[2] This allows them to perform complex simulations, optimizations, and cryptographical problems much faster than the classical machine.

While this hardware remains in early stages, it has the potential to disrupt industries ranging from finance and defense to pharmaceuticals and energy.[3]

Market Growth and Financial Performance

The global quantum technology market is projected to reach $1.88B in 2025, a 27.3% increase from $1.48B in 2024. McKinsey projects the quantum computing market will reach between $28B and $72B by 2035[4], the growth driven by escalating demand for computational power and secure communications. While much of this growth is expected to stem from specialized computing hardware, software-based or hybrid approaches are being explored as lower-cost, nearer-term alternatives.

The Quantum Insider predicts that quantum computing could generate over $1 trillion in economic impact by 2035, with quantum vendors expected to accrue about $50 billion in revenue over that period.[5]

This expansion will be driven by advances is quantum hardware, the rise of quantum software and cloud-based quantum services (QaaS), and increasing demand for secure communications, optimization, and simulation capabilities across industries.

As a Growth Engine

While hardware development commands the largest share of investment, quantum software is emerging as another critical component. Companies are developing specialized algorithms and applications for finance, pharmaceuticals, logistics, and more, accelerating commercial adoptions of quantum solutions. These software mimic quantum computational behavior on classical systems using multi-dimensional math.

Cloud-based quantum computing services are democratizing access to quantum resources in the form of Quantum-as-a-Service (Qaas). Platforms like Amazon Braket, IBM Quantum, and Microsoft Azure Quantum allow enterprises to experiment and deploy quantum applications without direct hardware investment, fueling rapid market expansion.

Recent data shows that the global quantum technology job market saw a 4.4% increase in jobs over the trailing 12-months as of April 2025. [6] By 2030, the quantum technology sector is expected to see significant job creation alongside its market expansion. The Quantum Insider projects that the quantum sector will generate approximately 250,000 new jobs by 2030, a substantial increase from current employment levels. [5]

Financial services are at the forefront of quantum software adoption, with early use cases in risk analysis, portfolio optimization, and cryptography. Quantum software is also enabling breakthroughs in drug discovery, materials science, and supply chain optimization. [1]

Current Key Players

|

Company |

Focus Area |

Recent Highlights |

|

IonQ |

Trapped Ion Hardware |

Stock up 35% |

|

D-Wave |

Quantum Annealing |

Commerical optimization solutions |

|

Superconducting Qubits |

Market gains, expanding partnerships |

|

|

IBM, Amazon, Microsoft |

Universal Gate-Model Hardware & Cloud Services |

Leading QaaS platforms |

Regional Trends

· North America remains the largest market, driven by strong public and private investment

· Asia-Pacific, especially China, is rapidly expanding its market due to large government funding

· Europe is advancing quantum communication and cryptographic initiatives

Market Outlook and Risks

In terms of growth projections, according to Boston Consulting Group [7], the global quantum technology market is projected to reach $100–170 billion by 2040. However, currently, despite rapid stock appreciation, many quantum companies, including IonQ, remain unprofitable and face steep R&D costs. IonQ for example, trades at a P/S ratio of 230. [8]

Recent surges in quantum stocks have been driven by more executive narratives and market sentiment rather than concrete financial results and commercial breakthroughs.[9] Technical hurdles are very prevalent, including error correction, hardware scalability, and talent shortages. Future market adoption will depend on the continued progression in these areas and the industry of quantum software in general. [10]

Potential government backed initiatives, such as the National Quantum Initiative Reauthorization Act, could provide the much needed funding to this sector, but the benefits remain prospective rather than guaranteed. [9]

ArcStone’s View

The quantum technology sector is at a crossroads. While investor enthusiasm is fueling rapid growth and market momentum, short term risks such as high valuations and technological limitations remain significant. In the near term, quantum software and cloud based quantum services are expected to be major engines for this markets expansion, enabling broader access and early commercial applications.

Looking ahead, as quantum hardware matures and becomes more reliable/accessible, its set up to become a transformative technology across all industries. This convergence of advanced technology with sophisticated software technologies will unlock new potential, making quantum technology a game changer for all sectors.

For investors, quantum technology has the potential to offer an asymmetric risk, a single breakthrough could dramatically reshape the landscape and deliver returns, but the path is uncertain littered with both technical and market risks. While this sector is charting lots of investment and enthusiasm, commercialization on the large scale is likely years away, maybe decades. The opportunity is compelling, but investors should be prepared for volatility and a long-term horizon as the technology matures and navigates complex risks.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients with financings, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.