SolarBank (NASDAQ: SUUN | CBOE CA: SUNN) Accelerating the North America Energy Transition

Executive Summary & Company Background

SolarBank Corporation (NASDAQ: SUUN | CBOE CA: SUNN) ("SolarBank" or "the Company") is a North America-based, publicly listed renewable energy platform specializing in the development, financing, and operation of distributed and community solar projects across the United States and Canada. [1]

Founded in 2013 and headquartered in Toronto, SolarBank specializes in designing, developing, and operating solar photovoltaic (PV) power generation, battery energy storage systems (BESS), and electric vehicle (EV) charging infrastructure. The company’s expertise covers the full project lifecycle: site origination, grid interconnection, permitting, financing, engineering, procurement, construction, operation, and asset management. [2]

Business Model & Operations

SolarBank operates as a vertically integrated business model spanning the full value chain of solar and battery energy storage development, construction, and long-term asset management. The company identifies and originates sites, often repurposing underutilized land such as landfills, for grid-connected solar photovoltaic projects across the North American region. Once a site is secured, SolarBank manages permitting, engineering, procurement, construction, and oversees operations and maintenance, either for its own portfolio or for a third-party client.[1] This approach allows SolarBank to capture multiple revenue streams, including development fees, construction earnings, and recurring revenues from O&M contracts and long-term power purchase agreements (PPAs). The current portfolio includes distributed solar, large-scale community solar, BESS, and EV charging projects with a development pipeline exceeding 1 GW.

Key Metrics

|

Revenue (TTM) |

|

|

Gross Profit (TTM) |

|

|

Shares Outstanding |

~203.24M |

|

Market Cap |

CA $54.88M |

|

Enterprise Value |

CA $74.49M |

Recent Developments & Strategic Initiatives

● Secured a US$100M project financing agreement with CIM Group to fund 97MW of US solar projects, enabling SolarBank to expand its independent power producer portfolio without shareholder dilution. [4]

● Announced a US$49.5M partnership with Qcells for the development and construction of four community solar projects in New York, utilizing “Made-in-USA” solar panels and strengthening the domestic solar supply chain.[5]

● Launched a Bitcoin treasury strategy, becoming one of the first renewable energy companies to allocate project cash flows to Bitcoin purchases, aiming to boost financial resilience and attract new tech-focused investors.[6]

● Announced development of a 6.9 MW community solar project in Brooklyn, Nova Scotia, under Canada’s first Community Solar Program; the CA $13.9M project will power approximately 900 homes and is scheduled for completion in summer 2026.[7]

Renewable Energy Market & Outlook

The global renewable energy market is undergoing rapid expansion largely driven by investment, technological advances, and strong policy support. In 2025, global energy investment is set to reach an all-time high of $3.3T, with clean energy solutions – including renewables, nuclear, and storage, attracting $2.2T, double the investment expected for fossil fuels.[8] Solar power is the largest beneficiary, with investment forecast to hit $450B in 2025, while battery storage spending is projected to reach $66B as grid reliability and energy storage become increasingly critical. [9]

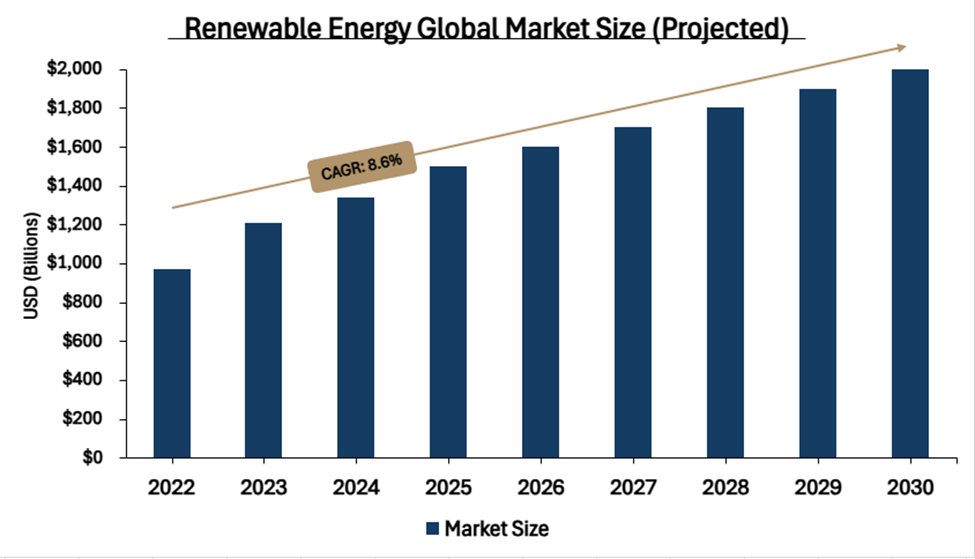

The sector’s growth is reflected in market size projections: the global renewable energy market is expected to be valued at $1.5T in 2025 and could surpass $2T by 2030, with a compound annual growth rate (CAGR) of 8.6%. [10]

Risk Management

A core element of SolarBank’s business model is its risk management approach. Recognizing that both the development and operational stages of renewable energy projects are exposed to uncertainties in permitting, financing, and regulatory incentives, the company implements comprehensive risk mitigation processes at each project phase. SolarBank regularly reviews its exposure to changes in government policies, market conditions, and funding schemes, and maintains flexibility in its strategy to adapt to evolving regulatory and financial environments. The company also discloses key risks and mitigation strategies in its public filings (Management Discussion and Analysis), emphasizing liquidity management, the use of banking and borrowing facilities, and a commitment to maintaining proper internal controls to support project resilience. [11]

ArcStone’s View

SolarBank stands as a comprehensive renewable energy developer with a strong portfolio of distributed, community, and utility-scale solar projects. Its ability to secure major financing, like the recent US$100M CIM Group deal, positions the company for scalable growth as clean energy demand accelerates, especially from sectors like data centers. While recent financials have been volatile, SolarBank’s adaptable strategy, disciplined risk management, and positive long-term outlook make it well-positioned to benefit from the ongoing energy transition.

About ArcStone Securities and Investments Corp.

ArcStone Securities and Investments Corp. is a leading financial services firm specializing in capital markets, corporate finance, and strategic advisory services. We assist clients with financings, navigating IPOs and RTOs, and executing mergers and acquisitions with precision and expertise. Additionally, we provide comprehensive debt financing solutions and a wide range of financial services to meet the unique needs of our clients. Our dedicated team of professionals offers tailored solutions to help businesses achieve their financial objectives and thrive in a competitive market. Discover how ArcStone can support your growth journey by visiting our website at arcstoneglobalsecurities.com.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.