Swing Into The Future With Newton Golf

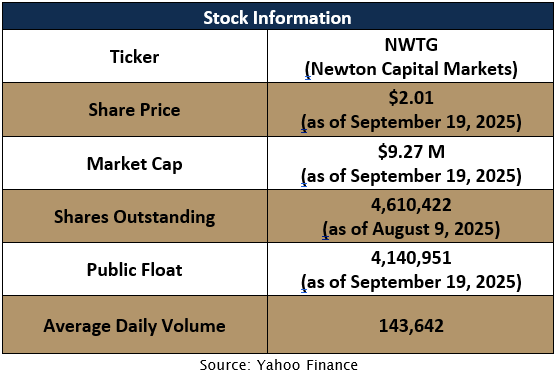

Company Snapshot

Newton Golf, formerly Sacks Parente, is a vertically integrated golf brand blending sport and technology. The company designs and manufactures premium putters, shafts, and grips in the U.S., enabling tight quality control, rapid innovation, and scalability across DTC and wholesale channels. With 182% YoY growth, Newton is emerging as a disruptive challenger in the premium golf market.1

Investment Thesis

The golf shaft is the engine of the golf club, and Newton’s technology-driven shafts unlock a level of precision, consistency, and adaptability that the industry has never seen. By addressing the true performance bottleneck, energy transfer and swing efficiency, Newton transforms the shaft from a passive component into an active driver of distance, accuracy, and feel. This innovation parallels the impact of Callaway’s Big Bertha in the 1990s, which redefined the driver category and catapulted Callaway into a market leader. Just as Big Bertha became the must-have upgrade that reshaped consumer expectations, Newton’s shafts have the potential to trigger a similar revolution in club performance, positioning the company to emerge as the next transformative brand in golf equipment.

Key Themes

- Undervalued Opportunity: With its explosive 182% YoY growth, patented disruptive technology, and professional endorsements, which are not fully reflected in its $7.6M market cap compared to peers in the $8B+ premium golf equipment market.

- Vertical Integration: Internal control of R&D and U.S.-based manufacturing allows for faster innovation cycles and premium margin potential.

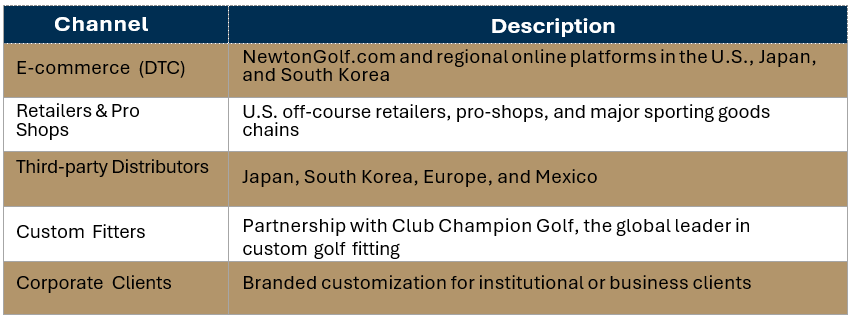

- Global Reach: Active distribution in the U.S., Japan, and South Korea with expansion into related golf accessories on the horizon.

- M&A Optionality: Future growth may be driven by tuck-in acquisitions or joint ventures to build out the Newton brand portfolio.

Key Highlights

- Explosive Growth: 182% YoY revenue growth supported by scalable business model.

- Disruptive Tech: Patented shafts and putters validated on pro tours; 50+ players across Champions, LPGA, and Korn Ferry adopting Newton gear.

- Market Validation: Recognized by Golf Magazine as a leading innovation; competitive edge over legacy brands like Fujikura and True Temper.

- Expanding Reach: Distribution through Club Champion (U.S.), major Japanese retailers, South Korean partners, and growing DTC sales.

- Secular Tailwinds: Benefiting from 5% annual golf equipment market growth, fueled by younger/women players and premiumization.

- Vertical Manufacturing: U.S.-based facilities enable quality control, fast innovation, and resilience to supply chain risks.

- Strong Team & Alignment: Experienced leadership with insider buying signals confidence in long-term trajectory.

Capital Use & Strategy

Proceeds have been directed toward:

- U.S.-based shaft manufacturing buildout

- Marketing & Branding

- Working capital and distribution expansion

- Long-term strategic positioning in global premium golf markets

- R&D for golf product lines

Market Opportunity:

The global golf equipment market was valued at $13.3B in 2023 and is projected to reach $17.6B by 2028, growing at a 5.7% CAGR. Newton Golf is positioned to benefit from several powerful structural drivers:

- Global Expansion of Golf: Over 206 countries and dependent territories now host golf participation, with more than 38,000 courses worldwide. The sport’s inclusion in the Olympic Games has further accelerated international adoption.

- Youth Participation: Golf is increasingly popular among younger demographics, supported by simulators, driving ranges, and off-course golf activities. These new formats lower barriers to entry and fuel long-term demand.

- Women’s Growth Segment: Women now account for 60% of new golfers in the U.S., representing the fastest-growing segment of participants.

- Asia-Pacific as a Growth Frontier: Japan remains a leading market (10.3M+ golfers), while South Korea, Thailand, India, and China show rapid growth in professional tournaments, retail spend, and recreational adoption. Rising disposable incomes and golf tourism further strengthen demand.

- Premiumization & Customization: Modern golfers increasingly demand personalized, high-performance clubs. This trend aligns directly with Newton’s technology-driven shafts and putters.3

Sales Channels

Flagship Product Lines

- ULBP Putters: Multi-material, ultra-low balance point design enhances tempo, release, and face control; lab-validated accuracy and feel gains.

- Motion Driver Shafts (2023): Features an Elongated Bend Profile, Kinetic Storage, Symmetry360, and DOT Flex System (1–6 precision scale), replacing outdated flex categories.

- Gravity Putters (2025 Pipeline): Next-gen models with proprietary metallurgy, premium face plates, and disruptive designs challenging blade/mallet norms.

- Visual Differentiation: Signature color-shifting shaft finishes reinforce premium brand identity.

Patent Portfolio

Newton Golf has developed a broad, defensible intellectual property portfolio that underpins its differentiation in the premium golf equipment market.

- Core Technology: Its Ultra-Low Balance Point (ULBP) putter innovation is protected through an international utility patent suite spanning the U.S., Canada, Europe, Japan, China, South Korea, Australia, and South Africa.

- Additional Patents: Multiple U.S. design patents and a utility patent for magnesium inserts further protect key elements of club construction and shaft geometry.

- Strategic Importance:

o Provides long-term defensibility against imitation.

o Reinforces Newton’s premium positioning in performance equipment.

o Creates optionality for licensing, OEM partnerships, or joint ventures in global golf markets. 4

Leadership Update

In June 2025, Newton Golf appointed Jeff Clayborne as Chief Financial Officer, signaling a transition toward operational scale-up and financial discipline. Clayborne previously served as CFO of a luxury lifestyle winterwear company, where he supported global brand expansion and IPO execution.5

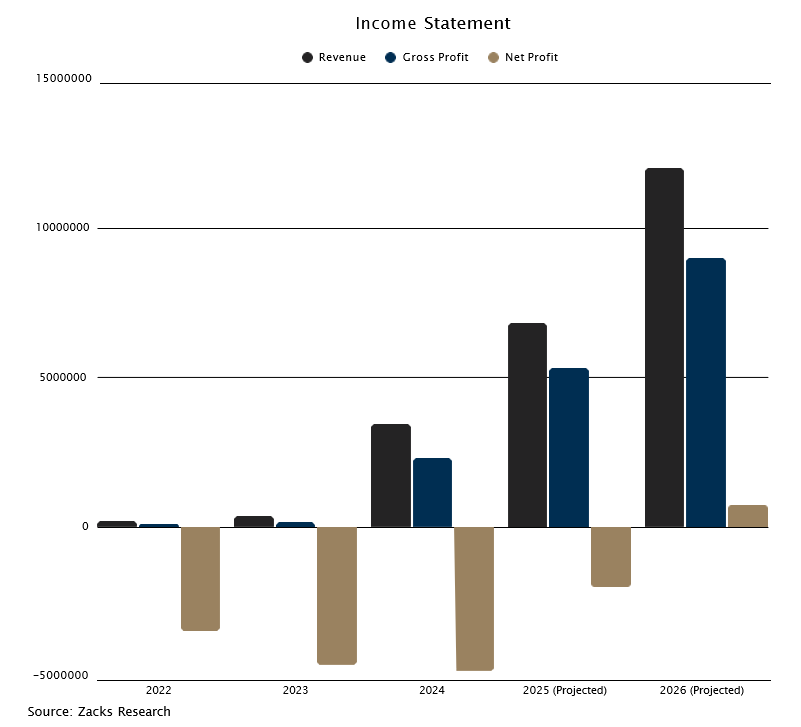

Financial Snapshot

From 2022 to 2024, the company demonstrated exceptional growth, with revenue rising from $190K to $3.45M. Gross profit followed the same trajectory, increasing from $80K to $2.3M, while margins strengthened significantly from 42% in 2022 to 66% in 2024. This reflects the company’s ability to scale while simultaneously improving efficiency and cost management. Looking ahead, by 2026 (projected) the business is expected to generate $12M in revenue and $9M in gross profit, translating into margins close to 75%. This progression underscores a clear path from early-stage growth to large-scale operations, with profitability firmly in sight.

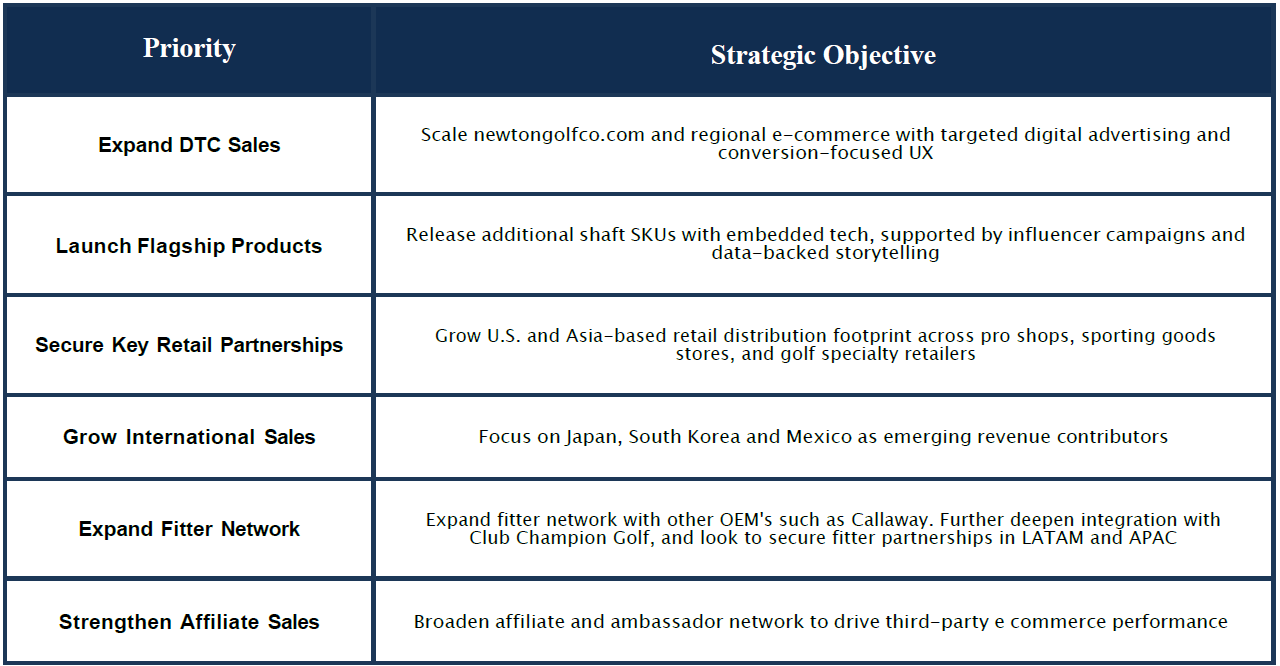

Short term Growth Priorities (12-24 months)

Newton Golf’s near-term strategy focuses on channel expansion, product visibility, and early-stage international scaling, supported by its recent capital raises and vertically integrated manufacturing platform.

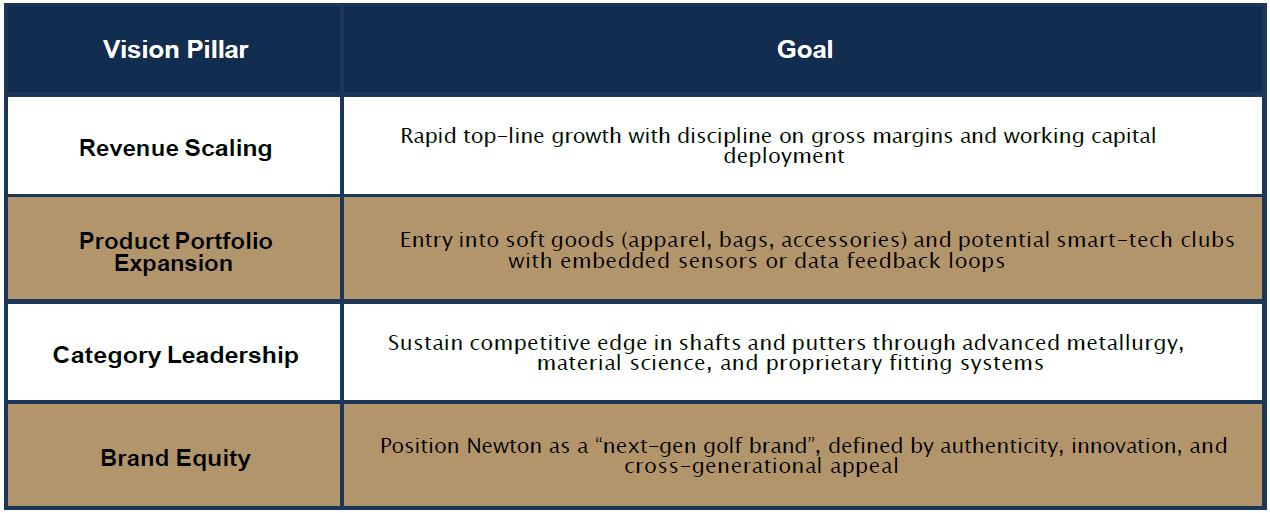

Long term Growth Priorities (3-5 years)

Looking out over a 3–5 year horizon, Newton aims to become a category-defining performance golf brand, with a scaled global footprint and diversified product mix.

Key Catalysts

- Q1 2026 Fast Motion Fairway wood shafts product launches.

- International distribution wins.

- Expanded OEM licensing opportunities.

- Potential strategic M&A situations.

Conclusion

From an analytical standpoint, Newton Golf represents an early-stage participant in the premium golf equipment segment, operating within a market characterized by steady growth and increasing demand for technology-enhanced performance products. The company’s vertically integrated U.S. manufacturing and patent portfolio contribute to its ability to control quality and manage innovation cycles internally. Its multi-channel distribution approach across North America and Asia reflects a strategy aimed at expanding visibility and reach.

While Newton has outlined a path toward profitability by 2026, execution will depend on the successful scaling of operations, continued market adoption, and effective management of production and capital resources. Key developments to monitor include upcoming product launches, international distribution agreements, and potential corporate transactions that could influence future performance.

Disclaimer and Forward Looking Statements

This company overview (the “Overview”) has been prepared by ArcStone Securities and Investments Corp. (“ArcStone”) for informational and marketing purposes only. It is intended solely for institutional, accredited, or qualified investors and does not constitute an offer to sell or a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. The information, opinions, and estimates contained herein reflect judgments as of the date of publication and are subject to change without notice. ArcStone makes no representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this Overview and expressly disclaims any and all liability arising from reliance thereon.

This Overview may contain statements that constitute “forward-looking statements” within the meaning of applicable securities laws in Canada and the United States. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “potential,” “target,” and similar expressions. These statements are based on current expectations, estimates, and assumptions and are inherently subject to significant risks and uncertainties including business, operational, financial, market, regulatory, and geopolitical risks that could cause actual results to differ materially from those expressed or implied.

Forward-looking statements in this Overview may include, but are not limited to, statements regarding the subject company’s future outlook, business strategy, financial results, exploration and development plans, budgets, litigation, or objectives. Readers are cautioned not to place undue reliance on such statements and should review all relevant risk factors described in the company’s most recent public filings and continuous disclosure documents. Forward-looking statements speak only as of the date they are made, and except as required by law, ArcStone assumes no obligation to update or revise any forward-looking statements.

This Overview is not, and under no circumstances, to be construed as, a prospectus, offering memorandum, advertisement, or public offering under any securities legislation. Nothing contained herein constitutes or should be deemed to constitute investment, legal, tax, accounting, or other professional advice, nor does this Overview constitute a recommendation to purchase, sell, or hold any security. Each recipient must conduct its own independent due diligence and consult its own advisors before making any investment decision.

ArcStone Securities and Investments Corp. is not a FINRA-registered broker-dealer and does not execute securities transactions or provide investment advice to U.S. persons. All U.S. registrable activities, including securities offerings, private placements, or introductions of U.S. investors are conducted exclusively through ArcStone Securities, LLC and Kingswood U.S., each a FINRA and SIPC member broker-dealer. In Canada, all registrable activities are conducted on a transaction-by-transaction basis through Sentinel Financial Group, a registered Exempt Market Dealer (EMD) in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Northwest Territories.

ArcStone and its affiliates operate in compliance with applicable FINRA, SEC, CIRO, and CSA requirements and maintain appropriate information barriers between investment banking, research, and marketing functions.

The issuer featured in this Overview (the “Company”) is a current or recent client of ArcStone or one of its affiliates. ArcStone and/or its affiliates have received or expect to receive cash and/or equity compensation for the provision of research, corporate advisory, investor relations, digital media, or capital markets consulting services to the Company. This relationship represents a potential conflict of interest, as ArcStone may be perceived to have an incentive to present the Company in a favorable light.

ArcStone’s U.S. affiliate, ArcStone Securities, LLC, may seek to act, or may have acted, as a placement agent or underwriter for the Company. The principals, officers, directors, employees, and related entities of ArcStone and its affiliates may, from time to time, own, buy, or sell securities or derivatives of the Company or its affiliates.

This Overview has been prepared by ArcStone’s Capital Markets and Research Division, which operates independently from transactional business lines. The authors have not been promised, nor received, compensation directly or indirectly related to the specific views or recommendations expressed herein. ArcStone maintains internal policies and procedures designed to manage conflicts of interest and uphold objectivity in its research and marketing publications.

This Overview is provided with the understanding that ArcStone is not acting in a fiduciary capacity. Recipients may not reproduce, distribute, or publish this Overview without the prior written consent of ArcStone. ArcStone assumes no obligation to update or amend this Overview or notify recipients if any information becomes inaccurate or misleading. By accepting this Overview, each recipient agrees to indemnify and hold harmless ArcStone and its affiliates from any claims, losses, or damages arising from reliance on this Overview or any errors or omissions herein.

Compensation Disclosure: ArcStone US Corp, a subsidiary of ArcStone Securities and Investments Corp. has received compensation for providing strategic and advisory services to the Company, one of which is the creation, publication, and distribution of a company featured overview. This represents a potential conflict of interest, and recipients should consider this when reviewing the content of this overview.

Principals and/or staff of ArcStone may own shares in the subject company.

@ 2025 ArcStone Securities and Investments Corp. All rights reserved.