Transforming Nutraceutical Innovation Through Science, IP, and Scalable Manufacturing

Company Overview

Healthy Extracts Inc. (OTCQB: HYEX) (“HYEX” or the “Company”) is a platform for acquiring, developing, patenting, marketing, and distributing plant-based nutraceuticals that deliver transformational health benefits. The firm has built a vertically integrated platform spanning ingredient acquisition, product development, patenting, manufacturing, and multi-channel distribution in the multi- billion-dollar nutritional supplement and alternative drug delivery markets.

Growth through strategic acquisition created its three product pillars:

- Bergamet NA™ (Feb 2019 acquisition)

- Ultimate Brain Nutrients (UBN™) (Apr 2021 acquisition)

- Gummy USA™ (Jul 2025 merger)

Together, these acquisitions give HYEX a unique competitive position:

1. Integrated manufacturing for scalability and margin control.

2. Patented formulations and exclusive delivery technologies (gummies, gel packs, straws).

3. Exclusive ingredients with superior clinical backing.

4. Omnichannel distribution (e-commerce, retail, influencer private label).

HYEX’s model is designed for both organic growth and bolt-on M&A, enabling it to rapidly expand product offerings while capturing economies of scale. 1

Industry & Market Opportunity

Global Nutraceutical Industry

Market Size: $459B in 2024 → $987B by 2032 (8.3% CAGR).2

Structural Growth Drivers:

- Rising healthcare costs ($4.8T in U.S., outpacing GDP growth).

- Shift toward preventive wellness over reactive treatment.

- Younger demographics favoring natural, convenient solutions.

- Increasing consumer trust in science-backed formulations. 2

Core Segments HYEX Targets

- Overall Nutraceutical Market: $459B (2024) → $987B (2032), CAGR 10.2%.

- Heart Health Ingredients: $21.1B (2024) → $55.3B (2030), CAGR 4.6%.

- Brain Health Supplements: $8.3B (2022) → $15.7B (2030), CAGR 9.4%.

- Digestive Health Products: $51.6B (2023) → $68.2B (2030), CAGR 8.3%.

- Gummy Supplements: $10.5B (2024) → $27.6B (2032), CAGR 4.2%.

Competitive Landscape

- Fragmented Market: No single dominant nutraceutical brand globally.

- Large Caps: Nestlé Health Science, Bayer, Herbalife, Amway, they have strong distribution but lack nimbleness and unique delivery tech.

- Direct Competitors: Companies like Nature Made, SmartyPants, Olly (gummies) – but few with patented delivery tech or exclusive high-potency ingredients.

- HYEX Differentiator: Proprietary formulations (Citrus Bergamot SuperFruit™), proprietary SureDose™ gummy manufacturing, exclusive delivery systems, and influencer-driven private label expansion.

Business Model & Differentiators

HYEX operates a vertically integrated nutraceutical platform, controlling the full product lifecycle from ideation → R&D → clinical testing → IP protection → in-house manufacturing → direct-to-consumer and wholesale distribution. This end-to-end model enables scale, protects margins, and supports both organic growth and bolt-on acquisitions.

Proprietary Edge

- Patented Formulations & Exclusive Delivery Systems: SureDose™ precision-dosed gummies, GelPacks, and Gut Health Straws differentiate HYEX from competitors.

- Clinical Validation: 17+ published studies supporting efficacy in cholesterol reduction, cognition, migraine relief, and statin tolerance.

- Exclusive Ingredients: U.S./Canada rights to Citrus Bergamot SuperFruit™, a higher- potency formulation than ~38% of competitors.

Sales Strategy

- High-ROI Digital Marketing: Proven model generating ~$1M revenue per $300K spend.

- Influencer Leverage: Exclusive branded lines and private-label partnerships reduce CAC and accelerate product adoption.

- Omnichannel Distribution: Combination of e-commerce, retail expansion, and influencer-driven channels provides scalable growth.

Key Differentiators

- Scalable Platform: End-to-end integration ensures speed, efficiency, and margin control.

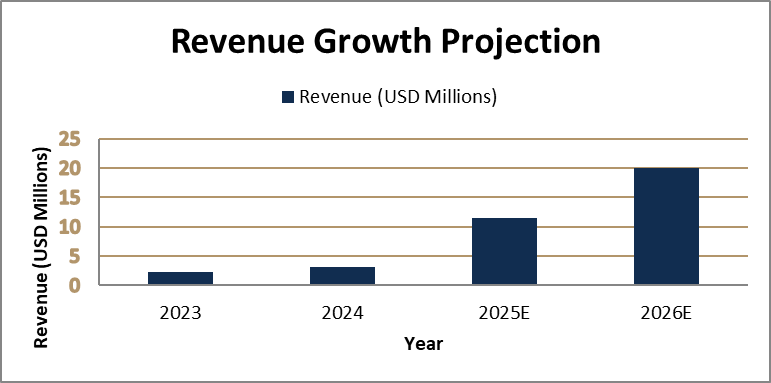

- Proven Revenue Growth: Clear path to $20M+ revenues with high-margin scalability.

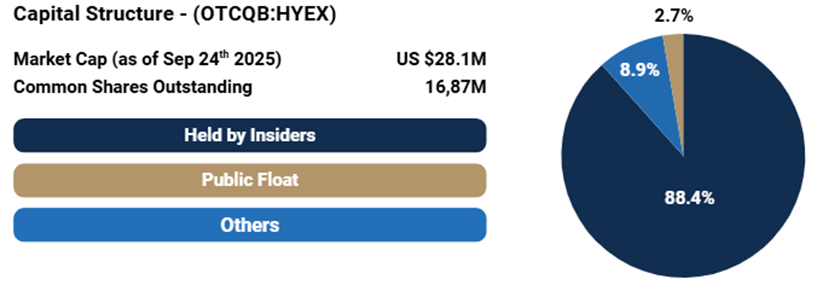

- Aligned Capital Structure: 89% insider ownership and low leverage underscore long- term value creation.

- Favorable Market Tailwinds: Positioned in nutraceutical categories with sustained double-digit CAGR.

Recent Developments

Gummy USA Acquisition (July 2025)

- Adds FDA-registered, GMP, HACCP-certified production capacity. Scalable to $20M+ in annual revenues. Unlimited growth potential with manufacturing expansion

- Proprietary SureDose™ technology enables precision manufacturing for B2B, private label, and clinical markets.

- Strategic synergies with HYEX brands: accelerates cross-selling and innovation pipeline.

Product Pipeline (2025)

- Launched: Natural Sleep, and Statin Users Formulas, Gut Health Straws, Hydration, and glucose Gel Packs.

- Planned (2026): Gummies: citrus bergamot, hair growth, anti-aging, workout, GLP-1 (support), and collagen.

Influencer Strategy

- Whitney Johns (1M+ followers): Exclusive branded line (women’s hormone support, brain health, gut straws).

- Private Label Program: Enables influencers to co-develop nutraceutical lines at low cost, accelerating product velocity.

Acquisitions

- Bergamet™ (Heart Health): Acquired Feb 2019. Exclusive U.S./Canada rights to high- potency Citrus Bergamot (47% BPF). Backed by 17+ clinical studies, 5x sales growth since acquisition.

- Ultimate Brain Nutrients (UBN™): Acquired Apr 2021. Proprietary nootropic complex with published clinical results. Sales doubled since acquisition; expanding into migraine and dementia support.

Financial Overview

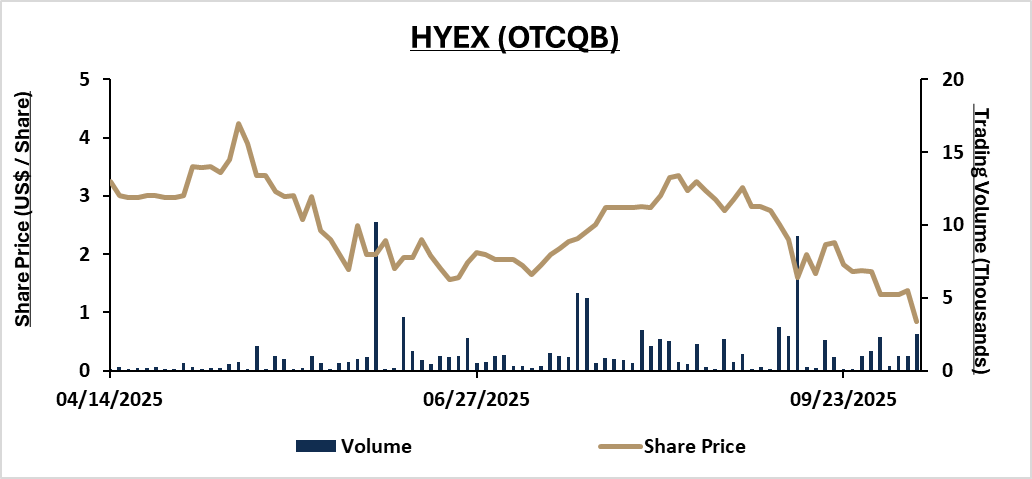

- Valuation: Market cap $28.1M → ~2.4x 2025E sales (below peers at 3–5x).

- Profitability: High gross margins expected from premium formulations and in-house production. Marketing efficiency demonstrated by strong ROI.

Catalysts

- Post-merger synergies: Scaling Gummy USA production + cross-selling across HYEX brands.

- Retail expansion: Additional grocer/pharmacy rollouts in 2026.

- New product launches: Gummies: citrus bergamot, hair growth, anti-aging, workout, GLP-1 (support), and collagen.

- M&A pipeline: Targeting under-distributed, IP-rich nutraceutical firms.

- Influencer network expansion: Additional partnerships beyond Whitney Johns.

- Consumer delivery advantage: Offers a full suite of delivery modalities (gummies, gel- based supplements, and functional straws), providing consumers with unmatched choice, convenience, and innovation across the nutraceutical market

Risks

- Execution: Integration of Gummy USA and ramp-up of production.

- Regulatory: FDA/FTC scrutiny over marketing and health claims.

- Liquidity: Thin float may limit institutional participation.

- Competition: Fragmented market; rivals may copy delivery formats.

- Dependence on marketing: Revenue tied to effectiveness of influencer campaigns.

Conclusion

HYEX sits at the intersection of nutraceutical innovation and preventive healthcare demand. With proprietary delivery systems, exclusive high-potency ingredients, clinical validation, and a scalable influencer/retail strategy, the company has a compelling runway for growth. The Gummy USA merger is transformative, providing FDA-registered, GMP-certified manufacturing capacity that can scale revenues meaningfully.

Looking ahead, HYEX is actively advancing toward an uplisting to a major exchange to enhance liquidity and unlock institutional investor participation. The roadmap includes sustained revenue growth beyond $20M+, strengthening governance and board independence, measured expansion of public float, and continued execution on a pipeline of IP-rich, clinically validated products.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.

Disclaimer and Forward Looking Statements

This company overview (the “Overview”) has been prepared by ArcStone Securities and Investments Corp. (“ArcStone”) for informational and marketing purposes only. It is intended solely for institutional, accredited, or qualified investors and does not constitute an offer to sell or a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. The information, opinions, and estimates contained herein reflect judgments as of the date of publication and are subject to change without notice. ArcStone makes no representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this Overview and expressly disclaims any and all liability arising from reliance thereon.

This Overview may contain statements that constitute “forward-looking statements” within the meaning of applicable securities laws in Canada and the United States. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “potential,” “target,” and similar expressions. These statements are based on current expectations, estimates, and assumptions and are inherently subject to significant risks and uncertainties including business, operational, financial, market, regulatory, and geopolitical risks that could cause actual results to differ materially from those expressed or implied.

Forward-looking statements in this Overview may include, but are not limited to, statements regarding the subject company’s future outlook, business strategy, financial results, exploration and development plans, budgets, litigation, or objectives. Readers are cautioned not to place undue reliance on such statements and should review all relevant risk factors described in the company’s most recent public filings and continuous disclosure documents. Forward-looking statements speak only as of the date they are made, and except as required by law, ArcStone assumes no obligation to update or revise any forward-looking statements.

This Overview is not, and under no circumstances, to be construed as, a prospectus, offering memorandum, advertisement, or public offering under any securities legislation. Nothing contained herein constitutes or should be deemed to constitute investment, legal, tax, accounting, or other professional advice, nor does this Overview constitute a recommendation to purchase, sell, or hold any security. Each recipient must conduct its own independent due diligence and consult its own advisors before making any investment decision.

ArcStone Securities and Investments Corp. is not a FINRA-registered broker-dealer and does not execute securities transactions or provide investment advice to U.S. persons. All U.S. registrable activities, including securities offerings, private placements, or introductions of U.S. investors are conducted exclusively through ArcStone Securities, LLC and Kingswood U.S., each a FINRA and SIPC member broker-dealer. In Canada, all registrable activities are conducted on a transaction-by-transaction basis through Sentinel Financial Group, a registered Exempt Market Dealer (EMD) in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Northwest Territories.

ArcStone and its affiliates operate in compliance with applicable FINRA, SEC, CIRO, and CSA requirements and maintain appropriate information barriers between investment banking, research, and marketing functions.

The issuer featured in this Overview (the “Company”) is a current or recent client of ArcStone or one of its affiliates. ArcStone and/or its affiliates have received or expect to receive cash and/or equity compensation for the provision of research, corporate advisory, investor relations, digital media, or capital markets consulting services to the Company. This relationship represents a potential conflict of interest, as ArcStone may be perceived to have an incentive to present the Company in a favorable light.

ArcStone’s U.S. affiliate, ArcStone Securities, LLC, may seek to act, or may have acted, as a placement agent or underwriter for the Company. The principals, officers, directors, employees, and related entities of ArcStone and its affiliates may, from time to time, own, buy, or sell securities or derivatives of the Company or its affiliates.

This Overview has been prepared by ArcStone’s Capital Markets and Research Division, which operates independently from transactional business lines. The authors have not been promised, nor received, compensation directly or indirectly related to the specific views or recommendations expressed herein. ArcStone maintains internal policies and procedures designed to manage conflicts of interest and uphold objectivity in its research and marketing publications.

This Overview is provided with the understanding that ArcStone is not acting in a fiduciary capacity. Recipients may not reproduce, distribute, or publish this Overview without the prior written consent of ArcStone. ArcStone assumes no obligation to update or amend this Overview or notify recipients if any information becomes inaccurate or misleading. By accepting this Overview, each recipient agrees to indemnify and hold harmless ArcStone and its affiliates from any claims, losses, or damages arising from reliance on this Overview or any errors or omissions herein.

Compensation Disclosure: ArcStone US Corp, a subsidiary of ArcStone Securities and Investments Corp. has received compensation for providing strategic and advisory services to the Company, one of which is the creation, publication, and distribution of a company featured overview. This represents a potential conflict of interest, and recipients should consider this when reviewing the content of this overview.

Principals and/or staff of ArcStone may own shares in the subject company.

@ 2025 ArcStone Securities and Investments Corp. All rights reserved.