Vision Marine Technologies - The Future of Electric Marine Propulsion

Company Snapshot

Vision Marine Technologies Inc. (NASDAQ: VMAR) (“Vision Marine” or the “Company”) is a Canadabased pioneer redefining marine electrification. Building on its success in electric outboards and fully electric boats, the company accelerated its growth with the June 2025 acquisition of Nautical Ventures Group, a top Florida recreational boating retailer with 5 dealerships across 9 locations. This strategic move propels Vision Marine into a dynamic, multi-channel business spanning retail distribution, aftersales service, rentals, and proprietary electric propulsion technology, unlocking powerful recurring revenue streams and positioning VMAR as the clear leader in the rapidly expanding marine electrification market.

Highlights

Vision Marine operates within the rapidly evolving electric boating industry, a segment that continues to gain attention as environmental regulations, consumer demand, and technological advancements accelerate the shift toward electrified marine solutions. The company’s focus on outboard boats and the watersports/cruising segments positions it in areas of growing interest among recreational users in North America and Europe, where infrastructure and adoption are advancing.

The recent acquisition of Nautical Ventures provides VMAR with an expanded distribution platform, complementary retail and service capabilities, and potential synergies across product development and customer engagement. In addition, strategic partnerships within the marine ecosystem may enhance brand visibility and operational reach as the market for electric propulsion solutions matures.

Looking ahead, factors that may influence VMAR’s performance include its ability to integrate acquired operations effectively, manage supply chain dependencies (particularly battery components), and navigate discretionary spending trends that affect consumer demand for recreational products. Market participants may continue to monitor execution milestones, revenue trends, and product adoption rates as indicators of progress within this emerging sector.1

Business Segments:

Nautical Ventures - Retail & Services

- Market Leader: #1 U.S. dealership (Boating Industry, 2024); greater than US $100M annual sales (2020–2023).

- Scale: 5 dealerships across 9 locations in Florida, two marinas, and yacht tender services.

- Customer Reach: 98,000+ client database; recurring aftermarket/service revenues.

- Performance: CA $153M pro forma revenue FY2024; new boats ~80% of sales, with Axopar boats contributing over half of revenues.

Electric High Voltage (HV) Powertrain and Technology

- Flagship: E-Motion™ 180 HP, world’s first certified continuous-use 180HP electric outboard.

- Efficiency Advantage: 96% vs ~54% competitor.

- OEM Adoption: Integrated into 24+ platforms, covering ~80% of Nautical Ventures’ brands.

- Industrial Scale: McLaren Engineering (Linamar) manufacturing; battery partners Octillion Power Systems & Neogy; integration with Nextfour & Weismann Marine.

- Specs: 180 HP, 250 ft.lb torque, 650V, 43 kWh lithium, water-cooled, third-party validated.

- More than 24 HV Voltage Powertrain System Integrations, across most of the major recreational boat platforms.2

Electric Boats & Rentals

- Boats: Seven electric models (45–58 units annually) serving as tech showcases + revenue generators.

- Rentals: 70,000+ rental experiences in CA & FL; rates $75–215/hour; boats resold after 200 hours.

- Brand Amplifier: Rentals drive visibility, customer adoption, and real-world validation.

Intellectual Property Strategy:

- Portfolio: 12 patents filed (of 24 planned), reinforcing competitive moat.

- Coverage:

- Safety: Fault detection, overload protection, torque fuse.

- Control Systems: Distributed architecture, motor/pump control.

- Power & Energy: Battery pack innovations, error response.

- Cooling & Reliability: Advanced water pump & intake control.

- Security: Cryptographic authentication & secure comms.

Industry Overview

The global recreational boating market was valued at US $39.7B in 2023 and is projected to expand to US $70.6B by 2032, representing a CAGR of 10%+ (2024–2032). This strong growth trajectory is underpinned by rising consumer appetite for premium leisure experiences, favorable macroeconomic trends, and advancing marine technologies. For investors, the sector presents a long-term capital appreciation opportunity, with premium brands, charter operators, and technology-enabled OEMs well positioned to capture outsized share.3

Key Growth Drivers

- Expanding User Base: Participation in water sports (jet skiing, yachting, kayaking, sailing) is broadening across age groups, with younger demographics increasingly adopting marine leisure activities. Lifestyle-driven adoption parallels the growth seen in golf and RV markets.

- Marine & Adventure Tourism Upside: Affluent travelers are driving demand for yacht charters, rentals, and premium marine experiences. Governments in coastal markets are actively investing in marinas, ports, and tourism promotion, creating infrastructure tailwinds for OEM and service providers.

- Technology Differentiation: Emerging propulsion systems (direct-injection engines, hybrid-electric, IoT-enabled smart navigation) provide efficiency and sustainability advantages. Companies integrating digital features (automation, connected dashboards) can capture margin premium and build ecosystem lock-in with accessories and upgrades.

Market Restraints

- High Initial & Ownership Costs: Boat prices rise with horsepower, customization, and luxury features. Additional ownership expenses include marina fees, insurance, taxes, and annual maintenance costs ranging from US $3,000–$10,000. These factors limit accessibility for middle-income consumers.

- Safety & Operational Risks: Rising boating accident rates have triggered tighter regulatory scrutiny, increasing compliance costs for OEMs and operators. Heightened enforcement may slow adoption in certain geographies unless offset by safety-enhancing technologies.

Opportunities

The recreational boating market, valued at US $30–40B in 2023, is shifting toward sustainable propulsion, with electric and hybrid solutions gaining traction. VMAR is ideally positioned to leverage the following opportunities and market segments:4

- Electrification & Hybrid Solutions: Growing environmental awareness and regulatory pressures are driving adoption of electric and hybrid boats, which offer quieter operation, lower emissions, and reduced maintenance costs. VMAR’s E-Motion 180E outboard system delivers zero-emission performance, aligning with sustainability goals and capturing the fast-growing electric segment (10–13% CAGR through 2035).

- Innovation in Engines: Demand for high-torque outboard engines is rising in performance boating. VMAR’s electric outboards provide superior torque and efficiency, offering a competitive edge over traditional twin-turbocharged engines while meeting eco-friendly demands.

- Lifestyle Customization: Rising consumer demand for sustainable materials and modular designs aligns with VMAR’s ability to offer customizable electric boats, appealing to eco-conscious buyers in the watersports and cruising segments.

Regional Insights

- North America: The largest market with over 60% global share in 2023, expected to grow at a 5.7% CAGR. Growth is fueled by high disposable incomes, widespread participation in water sports, strong dealer networks, and the presence of global leaders like Brunswick and Malibu Boats.

- Europe: Expected to grow at a 4.2% CAGR, driven by maritime traditions, tourism, and government promotion of sailing, rowing, and water sports. Approximately 6 million Europeans own boats, with 36 million participating regularly.

- Asia-Pacific: Expanding rapidly due to rising incomes in China, India, Southeast Asia, and South Korea. South Korea, in particular, is investing heavily in R&D and marine infrastructure to position itself as a regional boating hub.

- Latin America & Middle East: Growth is supported by rising HNWI populations, luxury tourism, and associations like LMA MENA that promote recreational boating.

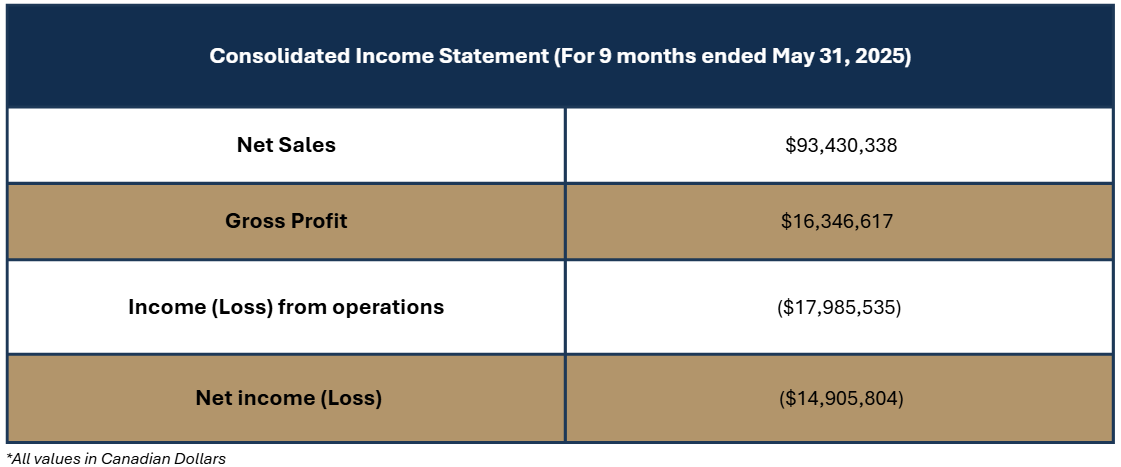

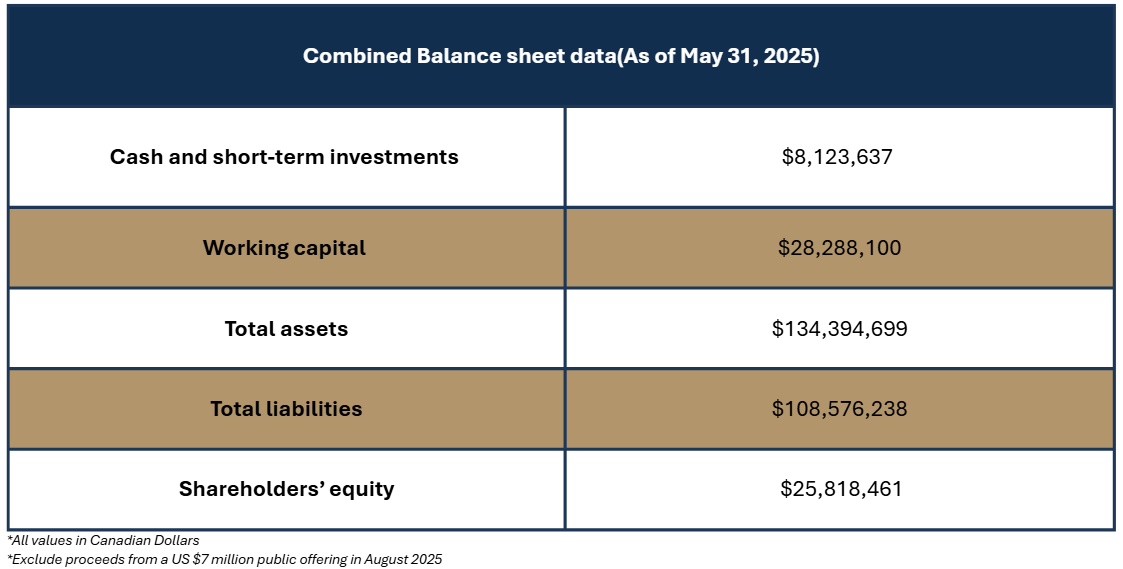

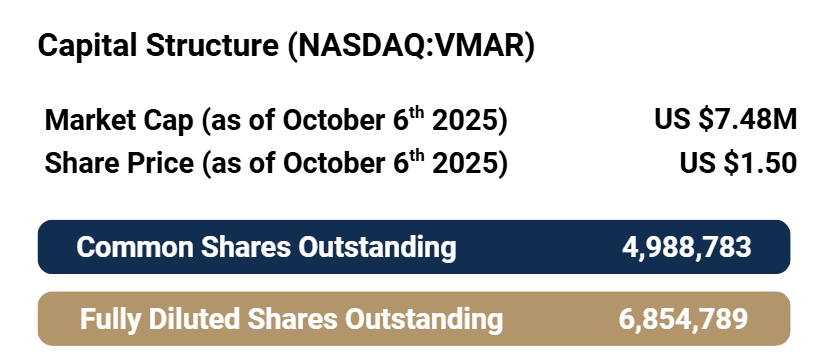

Financial Snapshot

Financial Highlights

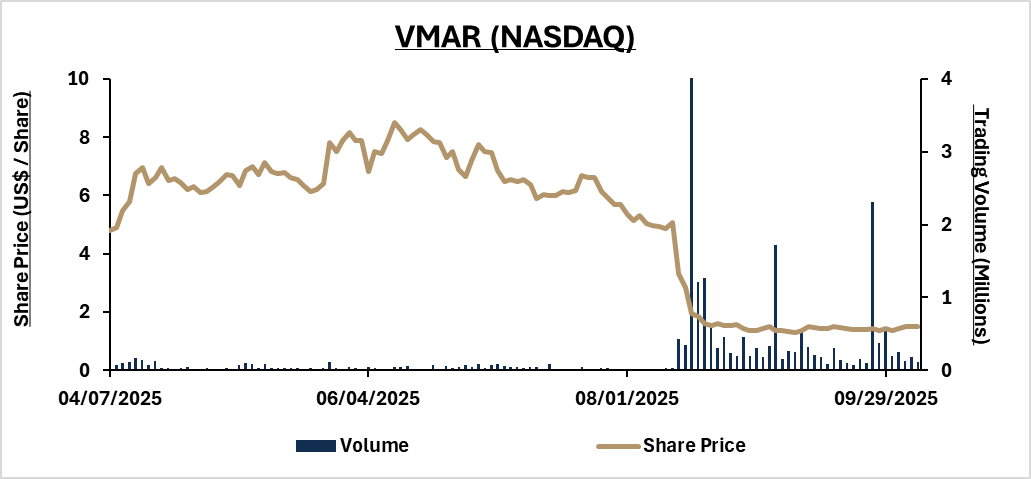

- Market Cap: US $7.5M (as of Oct 06, 2025).

- Convertible Notes: US $3.6M (convertible at $8.624/share), issued to former Nautical Ventures owners.

- Inventory & Loans: CA $101.1M in inventory (after write-down at acquisition date); US $31.3M in floor plan loans.

- Real Estate Option: Right to acquire properties with ~US $11M net equity value.

- Recent Financing: US $7M raised in a public offering (Aug 2025).

Strategic Focus and Growth Opportunities

- Margin Expansion: Improve profitability through services, financing & insurance (F&I), and stronger operational integration.

- OEM Partnerships: Broaden adoption of E-Motion™ via expanded OEM and white-label integrations.

- M&A Potential: Fragmentation across OEMs, component suppliers, and charter operators provides a backdrop for strategic consolidation, enabling scaled players (e.g., Brunswick, Groupe Beneteau) to capture synergies. Pursue targeted acquisitions to accelerate growth and extend market reach.

- Geographic Expansion: Grow dealership footprint beyond current regions.

- Diversified Revenue Streams: Beyond vessel sales, additional recurring revenue streams from maintenance, financing, insurance, marinas, and technology subscriptions

Risks

- Ongoing losses: Continued net losses raise doubt about our ability to continue without additional capital.

- Capital & financing: Significant capital needs; future financings may be dilutive or on unfavorable terms.

- Supplier & manufacturer dependence: Reliance on key personnel and a limited number of suppliers/manufacturers exposes us to concentration risk.

- Industry volatility: Boating industry demand is highly seasonal and sensitive to economic conditions, interest rates, inflation, and weather.

- Electric operations risk: Uncertain consumer adoption, product range limitations, and reliance on few suppliers/partners may hinder growth.

Leadership

- Alexandre Mongeon, Chief Executive Officer & Director: Co-Founder of Vision Marine, Mongeon has over 25 years of experience in the boating industry, with a strong background in electrification and battery technologies. He leads the company’s strategic, engineering, and production efforts.

- Raffi Sossoyan, Chief Financial Officer: A Chartered Professional Accountant (CPA), Sossoyan brings more than 25 years of multinational experience in accounting, finance, treasury, risk, and taxation. He has held senior roles across both public and private companies.

- Daniel “Dan” Rathe, Chief Technology Officer: Rathe has over 7 years of technical leadership in maritime energy storage and propulsion systems. His work has focused on integration of high-voltage systems and compliance with marine standards (DNV-GL, ABS, USCG), supporting Vision Marine’s technology development.

Conclusion

Vision Marine Technologies is at a pivotal inflection point following its transformational acquisition of Nautical Ventures. The combination of advanced electric propulsion technology, a robust retail platform, and recurring service revenues establishes a vertically integrated foundation rarely seen in the recreational boating sector. With OEM adoption of the E-Motion™ system accelerating, a deep intellectual property portfolio, and a scalable infrastructure in place, Vision Marine is positioned to convert innovation into sustainable profitability. While short-term challenges remain around capital efficiency and integration, the company’s strategy aligns with the global shift toward electrification and sustainable marine mobility.

ArcStone Financial Pulse Team

Stay informed with the latest market trends and investment insights from ArcStone Securities and Investments Corp. Subscribe to our newsletter for more detailed reports and analysis.

Disclaimer and Forward Looking Statements

This document has been prepared by ArcStone Securities and Investments Corp. (“ArcStone”) for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities. The information contained herein is subject to change without notice, and ArcStone assumes no obligation to update or revise any information.

This document includes certain statements that constitute “forward-looking statements” within the meaning of applicable Canadian and United States securities laws. All statements, other than statements of historical fact, may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “believe,” “anticipate,” “estimate,” “project,” “intend,” “expect,” “may,” “will,” “plan,” “should,” “would,” “contemplate,” “possible,” “attempts,” “seeks,” “goals,” “targets,” and similar expressions. These statements are based on current expectations, estimates, projections, and assumptions, and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this document may include, but are not limited to, statements regarding the subject company's future outlook, anticipated events or results, exploration and development plans, financial position, business strategy, budgets, litigation, projected costs, financial results, taxes, plans, and objectives. These statements are based on certain assumptions and analyses made by management in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate in the circumstances. However, actual results and developments are subject to a number of risks and uncertainties, including but not limited to, risks inherent to mineral exploration and development activities, changes in commodity prices, changes in interest and currency exchange rates, inaccurate geological and metallurgical assumptions, unanticipated operational difficulties, government action or delays in the receipt of government approvals, adverse weather conditions, unanticipated events related to health, safety, and environmental matters, labor disputes, political risk, social unrest, failure of counterparties to perform their contractual obligations, changes or further deterioration in general economic conditions, and other risks discussed under the heading "Risk Factors" in the subject company's most recently filed MD&A. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made. Except as required by applicable law, ArcStone assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions, or changes in other factors affecting the forward-looking statements.

This document is not, and under no circumstances is to be construed as, a prospectus, a public offering, or an offering memorandum as defined under applicable securities legislation anywhere in Canada, the United States, or in any other jurisdiction. Neither this document nor anything in it shall form the basis of any contract or commitment. This document is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate.

ArcStone Securities and Investments Corp. is not a registered broker-dealer and does not provide investment advice or recommendations. All registrable activities and services, including capital raises in the USA, are provided through ArcStone Securities, LLC and Kingswood US, both of which are FINRA-registered broker-dealers. In Canada, on a transaction-by-transaction basis, all registrable activities are conducted through Sentinel Financial Group, a registered Exempt Market Dealer (EMD) in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Northwest Territories.

Compensation Disclosure: ArcStone US Corp, a subsidiary of ArcStone Securities and Investments Corp. has received compensation for providing strategic and advisory services to the Company, one of which is the creation, publication, and distribution of a company featured report. This represents a potential conflict of interest, and recipients should consider this when reviewing the content of this report.

The Principals, related companies or affiliates, and/or staff of ArcStone may own shares in this Company.